MoneyGram 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

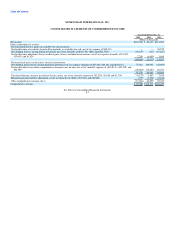

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

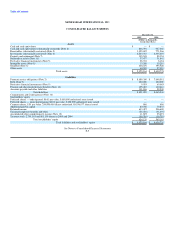

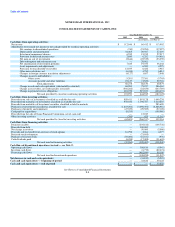

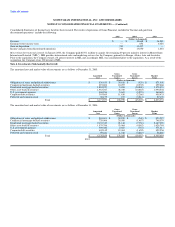

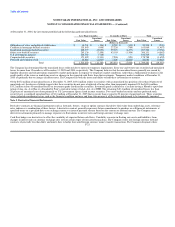

fluctuations in the value of investments. The following table shows the total amount of unrestricted assets at December 31:

2005 2004

(Dollars in thousands)

Cash and cash equivalents $ 866,391 $ 927,042

Receivables, net 1,325,622 771,966

Investments 6,233,333 6,335,493

8,425,346 8,034,501

Amounts restricted to cover payment service obligations (8,059,309) (7,640,581)

Unrestricted assets $ 366,037 $ 393,920

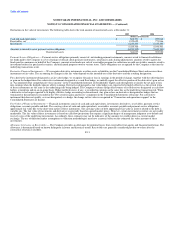

Payment Service Obligations — Payment service obligations primarily consist of: outstanding payment instruments; amounts owed to financial institutions

for funds paid to the Company to cover clearings of official check payment instruments, remittances and clearing adjustments; amounts owed to agents for

funds paid to consumers on behalf of the Company; amounts owed under our sale of receivables program for collections on sold receivables; amounts owed to

investment brokers for purchased securities; and unclaimed property owed to various states. These obligations are recognized by the Company at the time the

underlying transactions occur.

Derivative Financial Instruments — We recognize derivative instruments as either assets or liabilities on the Consolidated Balance Sheet and measure those

instruments at fair value. The accounting for changes in the fair value depends on the intended use of the derivative and the resulting designation.

For a derivative instrument designated as a fair value hedge, we recognize the gain or loss in earnings in the period of change, together with the offsetting loss

or gain on the hedged item. For a derivative instrument designated as a cash flow hedge, we initially report the effective portion of the derivative's gain or loss

in "Accumulated other comprehensive (loss) income" in the Consolidated Statement of Stockholders' Equity and subsequently reclassify the net gain or loss

into earnings when the hedged exposure affects earnings. Derivatives designated as fair value hedges are expected to be highly effective as the critical terms

of these instruments are the same as the underlying risks being hedged. The Company evaluates hedge effectiveness of its derivatives designated as cash flow

hedges at inception and on an on-going basis. Hedge ineffectiveness, if any, is recorded in earnings on the same line as the underlying transaction risk. When

a derivative is no longer expected to be highly effective, hedge accounting is discontinued. Any gain or loss on derivatives designated as hedges that are

terminated or discontinued is recorded in the "Net securities gains and losses" component in the Consolidated Statements of Income. For a derivative

instrument that does not qualify, or is not designated, as a hedge, the change in fair value is recognized in "Transaction and operations support" in the

Consolidated Statements of Income.

Fair Value of Financial Instruments — Financial instruments consist of cash and cash equivalents, investments, derivatives, receivables, payment service

obligations, accounts payable and debt. The carrying values of cash and cash equivalents, receivables, accounts payable and payment service obligations

approximate fair value due to the short-term nature of these instruments. The carrying values of debt approximate fair value as interest related to the debt is

variable rate. The fair value of investments and derivatives is generally based on quoted market prices. However, certain investment securities are not readily

marketable. The fair value of these investments is based on cash flow projections that require a significant degree of management judgment as to default and

recovery rates of the underlying investments. Accordingly, these estimates may not be indicative of the amounts we could realize in a current market

exchange. The use of different market assumptions or valuation methodologies may have a material effect on the estimated fair value amounts of these

investments.

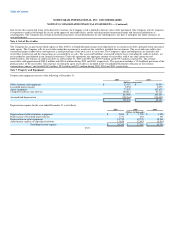

Allowance for Losses on Receivables — The Company provides an allowance for potential losses from receivables from agents and financial institutions. The

allowance is determined based on known delinquent accounts and historical trends. Receivables are generally considered past due two days after the

contractual remittance schedule, F-13