MoneyGram 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

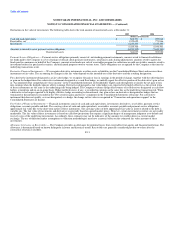

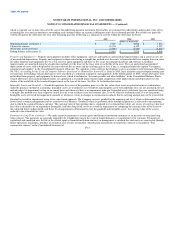

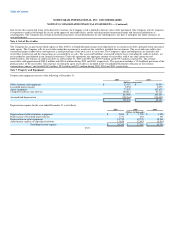

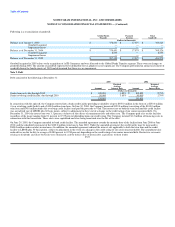

commission. The commission amount is generally based on a percentage of the fee charged to the customer. We generally do not pay commissions to agents

on the sale of money orders. Fee commissions are recognized at the time of the transaction. Fee commissions also include the amortization of the capitalized

incentive payments to agents.

Investment Commissions Expense — Investment commissions expense includes amounts paid to financial institution customers based upon average

outstanding balances generated by the sale of official checks and costs associated with swaps and the sale of receivables program. Commissions paid to

financial institution customers generally are variable based on short-term interest rates; however, a portion of the commission expense has been fixed through

the use of interest rate swap agreements. Investment commissions are generally recognized each month based on the average outstanding balances and the

contractual variable rate for that month.

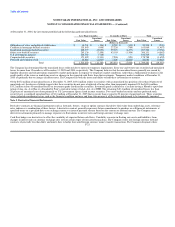

Stock Based Compensation — Through 2004, the Company accounted for stock option grants under the intrinsic value method in accordance with Accounting

Principles Board Opinion No. 25 ("APB 25"), Accounting for Stock Issued to Employees. This method defines compensation cost for stock options as the

excess, if any, of the quoted market price of the Company's stock at the date of the grant over the amount the employee must pay to acquire the stock. As our

stock option plans require the employee to pay an amount equal to the market price on the date of grant, no compensation expense was recognized under

APB 25. Performance-based stock and restricted stock awards were accounted for using the fair value method under SFAS No. 123, Accounting for Stock-

Based Compensation. Under SFAS No. 123, performance-based stock and restricted stock awards were valued at the quoted market price of the Company's

stock at the date of grant and expensed using the straight-line method over the vesting or service period of the award.

Effective January 1, 2005, the Company adopted SFAS No. 123R, Share-Based Payment, using the modified prospective method. Under SFAS No. 123R, all

share-based compensation awards are measured at fair value at the date of grant and expensed over their vesting or service periods. Expense is recognized

using the straight-line method.

As the Company adopted SFAS No. 123R under the modified prospective method, prior period financial statements are not restated. No modifications were

made to existing share-based awards prior to, or in connection with, the adoption of SFAS No. 123R. The adoption of SFAS No. 123R reduced income from

continuing operations before income taxes by $1.5 million and reduced net income by $1.1 million, respectively, for 2005. Basic and diluted earnings per

share in 2005 were reduced by $0.01. Cash used by operating activities and cash provided by financing activities during 2005 increased by $1.8 million as a

result of the adoption of SFAS No. 123R.

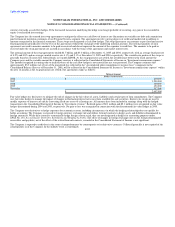

Recent Accounting Pronouncements — On March 29, 2005, the Securities and Exchange Commission ("SEC") issued Staff Accounting Bulletin ("SAB")

No. 107, which provides SEC interpretations regarding SFAS No. 123R. In particular, SAB No. 107 provides guidance related to share-based payment

transactions with non-employees, the transition from nonpublic to public company status, valuation methods, the accounting for certain redeemable financial

instruments issued under share-based payment arrangements, the classification of compensation expense, non-GAAP financial measures, the first-time

adoption of SFAS No. 123R in an interim period, capitalization of compensation cost, the accounting for income tax effects upon adoption of

SFAS No. 123R, the modification of employee share options prior to adoption of SFAS No. 123R and disclosures in Management's Discussion and Analysis

subsequent to adoption of SFAS No. 123R. As the Company adopted SFAS No. 123R effective January 1, 2005, SAB No. 107 was effective for the Company

on January 1, 2005. Applicable provisions of SAB No. 107 have been implemented by the Company in the adoption of SFAS No. 123R as disclosed in

Note 15.

In May 2005, the Financial Accounting Standards Board ("FASB") issued SFAS No. 154, Accounting Changes and Error Corrections, which replaces

APB No. 20, Accounting Changes, and SFAS No. 3, Reporting Accounting Changes in Interim Financial Statements. This statement requires that an entity

apply the retrospective method in reporting a change in an accounting principle or the reporting entity. The standard only allows for a change in

F-16