MoneyGram 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

loss of the client or other customers or prospects. We offer the special purpose entity to certain financial institution clients as a benefit unique in the payment

services industry.

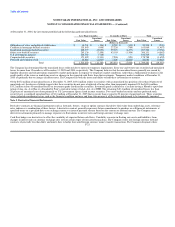

Certain structured investments we own represent beneficial interests in grantor trusts or other similar entities. These trusts typically contain an investment

grade security, generally a U.S. Treasury strip, and an investment in the residual interest in a collateralized debt obligation, or in some cases, a limited

partnership interest. For certain of these trusts, the Company owns a percentage of the beneficial interests which results in the Company absorbing a majority

of the expected losses. Therefore, the Company consolidates these trusts by recording and accounting for the assets of the trust separately in the consolidated

financial statements.

Management Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that

affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

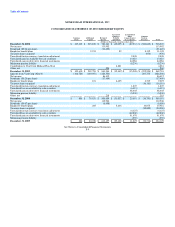

Reclassifications — Certain reclassifications have been made to prior period financial statements to conform to the current presentation. These

reclassifications were not material, individually or in the aggregate, and had no impact on net income or stockholders' equity as previously reported.

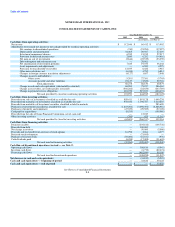

Statement of Cash Flows — In 2005, the Company changed its presentation of the Consolidated Statements of Cash Flows to separately disclose the

operating, investing and financing portions of the cash flows attributable to its discontinued operations. The Consolidated Statements of Cash Flows for the

years ended December 31, 2004 and 2003, which previously reported cash flows attributable to its discontinued operations on a combined basis, have been

retroactively revised for this change.

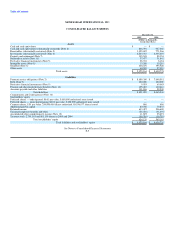

Cash and Cash Equivalents, Receivables and Investments — We generate funds from the sale of money orders, official checks (including cashier's checks,

teller checks, and agent checks) and other payment instruments (classified as "Payment service obligations" in the Consolidated Balance Sheets). The

proceeds are invested in cash and cash equivalents and investments until needed to satisfy the liability to pay the face amount of the payment service

obligations upon presentment.

Cash and Cash Equivalents (substantially restricted) — We consider cash on hand and all highly liquid debt instruments purchased with original maturities

of three months or less to be cash and cash equivalents.

Receivables, net (substantially restricted) — We have receivables due from financial institutions and agents for payment instruments sold. These receivables

are outstanding from the day of the sale of the payment instrument until the financial institution or agent remits the funds to us. We provide an allowance for

the portion of the receivable estimated to become uncollectible using historical charge-off and recovery patterns, as well as current economic conditions.

We sell an undivided percentage ownership interest in certain of these receivables, primarily receivables from our money order agents. The sale is recorded

in accordance with Statement of Financial Accounting Standards ("SFAS") No. 140, Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities. Upon sale, we remove the sold agent receivables from the Consolidated Balance Sheets as we have surrendered control over

those receivables.

Investments (substantially restricted) — Our investments consist primarily of mortgage-backed securities, other asset-backed securities, state and municipal

government obligations and corporate debt securities, and are recorded at fair value. These investments are held in custody with major financial institutions.

We classify securities as available-for-sale or held-to-maturity in accordance with SFAS No. 115, Accounting for Certain Investments in Debt and Equity

Securities. During the first quarter of 2003, we determined that we no longer had the positive intent to hold to maturity the securities classified as held-to-

maturity due to the desire to have more flexibility in managing the investment portfolio. Accordingly, on March 31, 2003, we reclassified securities in the

portfolio from held-to-maturity to available-for-sale. As a result of this reclassification, we could not classify

F-11