MoneyGram 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

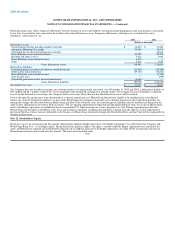

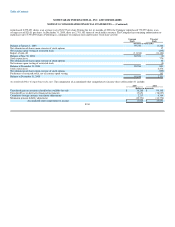

repurchased 2,275,651 shares at an average cost of $21.97 per share. During the last six months of 2004, the Company repurchased 770,299 shares at an

average cost of $21.01 per share. At December 31, 2005, there are 2,701,163 shares of stock held in treasury. The Company has remaining authorization to

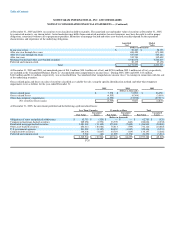

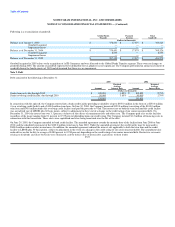

repurchase up to 3,954,050 shares. Following is a summary of common stock and treasury stock share activity:

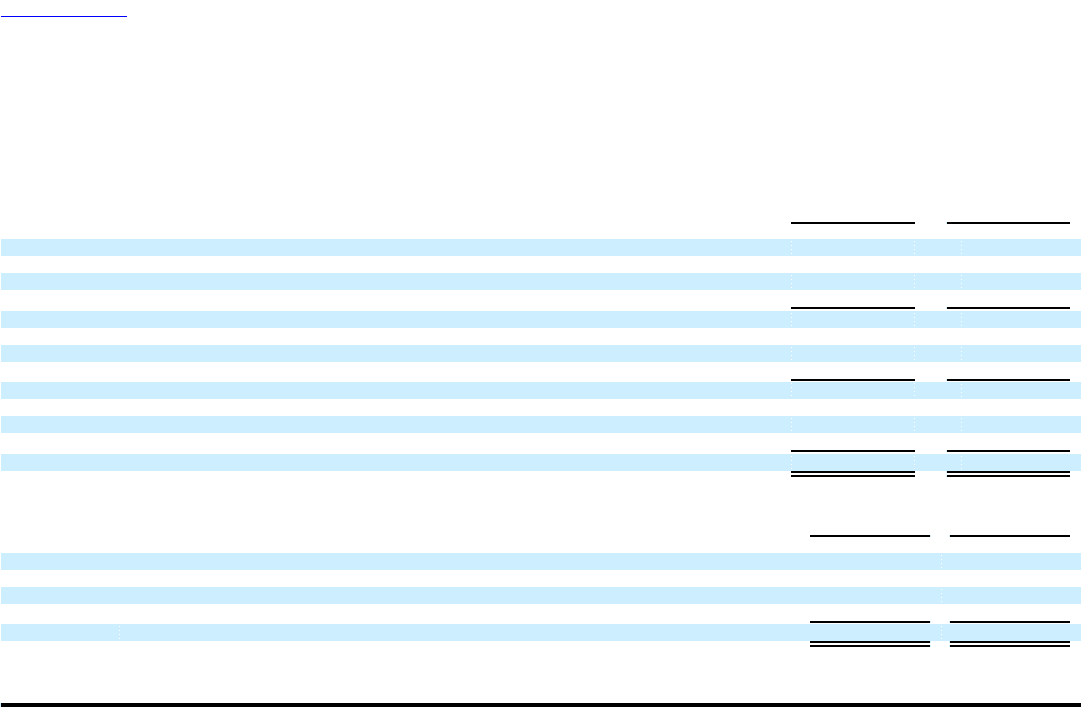

Common Treasury

Stock Stock

(Amounts in thousands)

Balance at January 1, 2003 99,740 11,382

Net submission of shares upon exercise of stock options 37

Net issuance upon vesting of restricted stock (235)

Impact of spin-off (11,184) (11,184)

Balance at June 30, 2004 88,556 (0)

Stock repurchases 770

Net submission of shares upon exercise of stock options 36

Net issuance upon vesting of restricted stock (5)

Balance at December 31, 2004 88,556 801

Stock repurchases 2,276

Net submission of shares upon exercise of stock options (559)

Forfeitures of restricted stock, net of issuance upon vesting 183

Balance at December 31, 2005 88,556 2,701

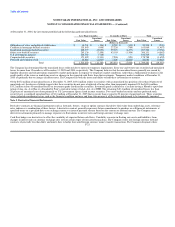

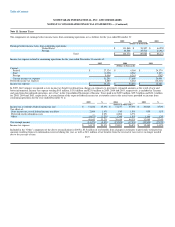

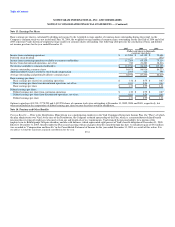

Accumulated Other Comprehensive Income: The components of accumulated other comprehensive income (loss) at December 31 include:

2005 2004

(Dollars in thousands)

Unrealized gain on securities classified as available-for-sale $ 38,288 $ 99,148

Unrealized loss on derivative financial instruments 13,651 (38,027)

Cumulative foreign currency translation adjustments 2,217 6,344

Minimum pension liability adjustment (42,331) (41,774)

Accumulated other comprehensive income $ 11,825 $ 25,691

F-30