MoneyGram 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

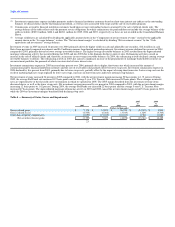

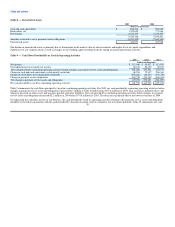

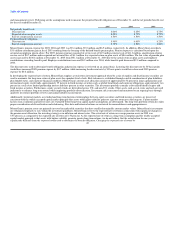

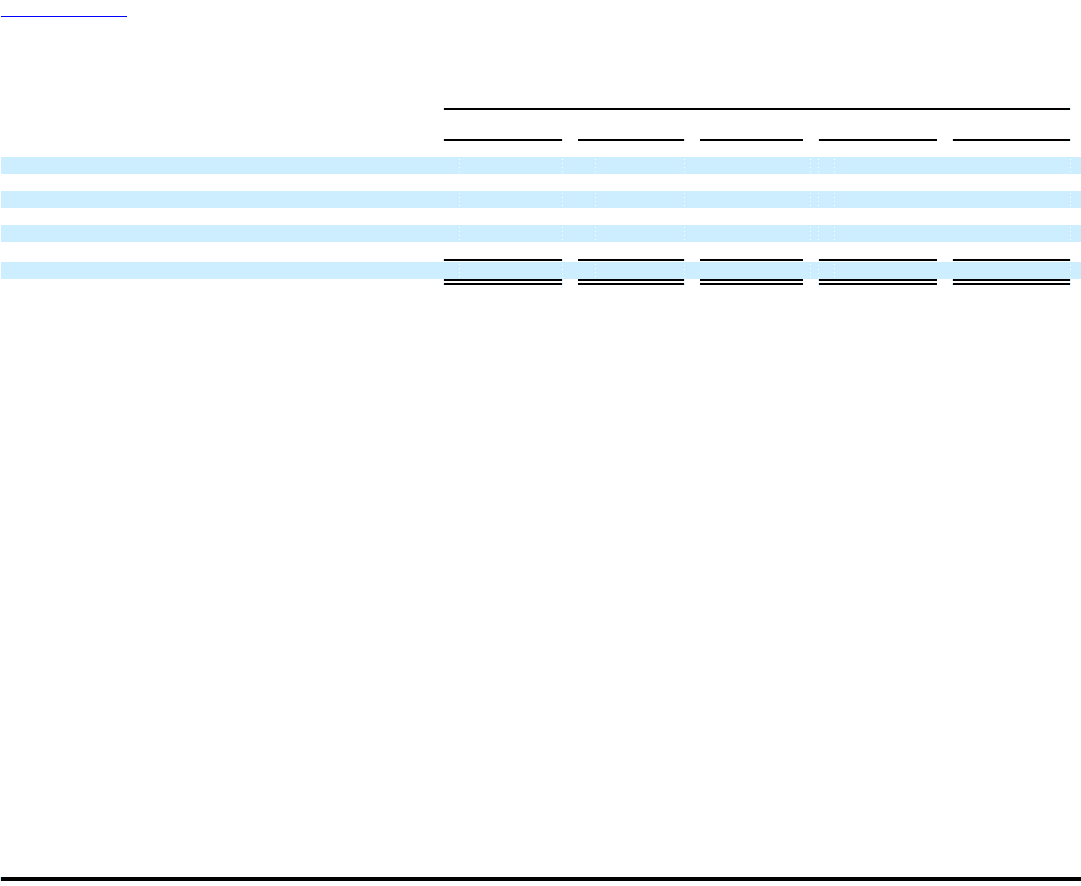

Table 12 — Contractual Obligations

Payments due by period

Less than More than

Total 1 year 1-3 years 3-5 years 5 years

(Dollars in thousands)

Debt $ 183,885 $ 7,530 $ 15,060 $ 161,295 $ —

Operating leases 43,490 5,534 10,161 10,107 17,688

Derivative financial instruments 23,688 8,473 12,138 3,120 (43)

Other obligations 6,096 6,096 — — —

Capital lease obligations 346 241 105 — —

Interim services agreement 100 100 — — —

Total contractual cash obligations $ 257,605 $ 27,974 $ 37,464 $ 174,522 $ 17,645

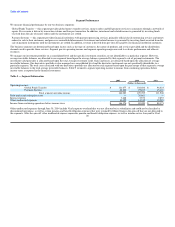

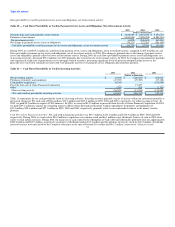

Debt consists of amounts outstanding under the term loan and revolving credit facility at December 31, 2005, as described in "Other Funding Sources," as

well as related interest payments. As described above, interest payments on our outstanding debt is based on a floating interest rate indexed to LIBOR. For

disclosure purposes, the interest rate for future periods has been assumed to be 5.02 percent, which is the rate in effect on December 31, 2005. Operating

leases consist of various leases for buildings and equipment used in our business. Derivative financial instruments represent the net payable (receivable) under

our interest rate swap agreements. Other obligations are unfunded capital commitments related to our limited partnership interests included in our investment

portfolio. The interim services agreement is the obligation under our agreement with Viad for certain services to be provided to the Company as described in

Note 3 of the Notes to the Consolidated Financial Statements.

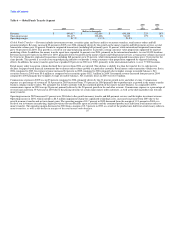

MoneyGram has funded, noncontributory pension plans. Our funding policy is to contribute at least the minimum contribution required by applicable

regulations. During 2005, MoneyGram contributed $13.0 million to the funded pension plans and expects to contribute $9.8 million in 2006. MoneyGram also

has certain unfunded pension and postretirement plans that require benefit payments over extended periods of time. During 2005, we paid benefits totaling

$2.9 million related to these unfunded plans. Benefit payments under these unfunded plans are expected to be $4.0 million in 2006. Expected contributions

and benefit payments under these plans are not included in the table above. See "Critical Accounting Policies — Pension obligations" for further discussion of

these plans.

Included in the Consolidated Balance Sheets under "Accounts payable and other liabilities" and "Property and equipment" is $1.6 million of property and

equipment received by the Company but not paid as of December 31, 2005. These amounts will be paid by the Company in January and February 2006.

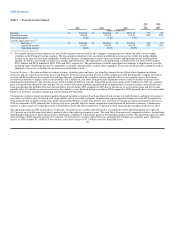

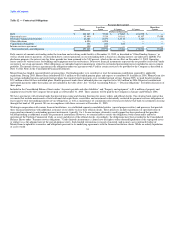

We have agreements with clearing banks that provide processing and clearing functions for money orders and official checks. One clearing bank contract has

covenants that include maintenance of total cash and cash equivalents, receivables and investments substantially restricted for payment services obligations at

least equal to total outstanding payment service obligations, as well as maintenance of a minimum ratio of total assets held at that bank to instruments clearing

through that bank of 103 percent. We are in compliance with these covenants at December 31, 2005.

Working in cooperation with various financial institutions, we established separate consolidated entities (special purpose entities) and processes that provide

these financial institutions with additional assurance of our ability to clear their official checks. These processes include maintenance of specified ratios of

segregated investments to outstanding payment instruments, typically 1 to 1. In one instance, alternative credit support has been purchased that provides

backstop funding as additional security for payment of instruments. However, we remain liable to satisfy the obligations, both contractually and/or by

operation of the Uniform Commercial Code, as issuer and drawer of the official checks. Accordingly, the obligations have been recorded in the Consolidated

Balance Sheets under "Payment service obligations." Under limited circumstances, clients have the right to either demand liquidation of the segregated assets

or replace us as the administrator of the special-purpose entity. Such limited circumstances consist of material (and in most cases continued) failure of

MoneyGram to uphold its warranties and obligations pursuant to its underlying agreements with the financial institution clients. While an orderly liquidation

of assets would 33