MoneyGram 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

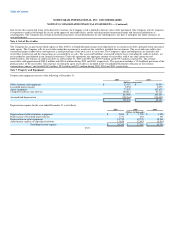

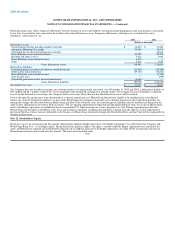

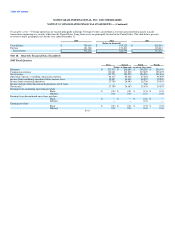

The benefit obligation and plan assets, changes to the benefit obligation and plan assets and a reconciliation of the funded status of the defined benefit pension

plan and combined SERPs as of and for the year ended December 31 are as follows:

2005 2004

(Dollars in thousands)

Change in benefit obligation:

Benefit obligation at the beginning of the year $ 194,272 $ 185,782

Service cost 1,893 1,717

Interest cost 11,320 11,333

Actuarial (gain) or loss 5,605 6,374

Plan amendments 227 —

Benefits paid (10,797) (10,934)

Benefit obligation at the end of the year $ 202,520 $ 194,272

Change in plan assets:

Fair value of plan assets at the beginning of the year $ 98,125 $ 96,435

Actual return on plan assets 5,728 7,771

Employer contributions 15,717 4,853

Benefits paid (10,797) (10,934)

Fair value of plan assets at the end of the year $ 108,773 $ 98,125

Reconciliations of funded status:

Funded (unfunded) status $ (93,747) $ (96,147)

Unrecognized actuarial (gain) loss 76,653 72,264

Unrecognized prior service cost 3,521 4,008

Net amount recognized in consolidated balance sheet $ (13,573) $ (19,875)

Amounts recognized in consolidated balance sheet:

Accrued benefit liability $ (83,739) $ (89,217)

Intangible asset 1,890 2,503

Deferred tax asset 25,945 25,065

Additional minimum liability 42,331 41,774

Net amount recognized in consolidated balance sheet $ (13,573) $ (19,875)

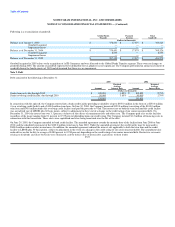

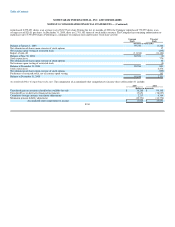

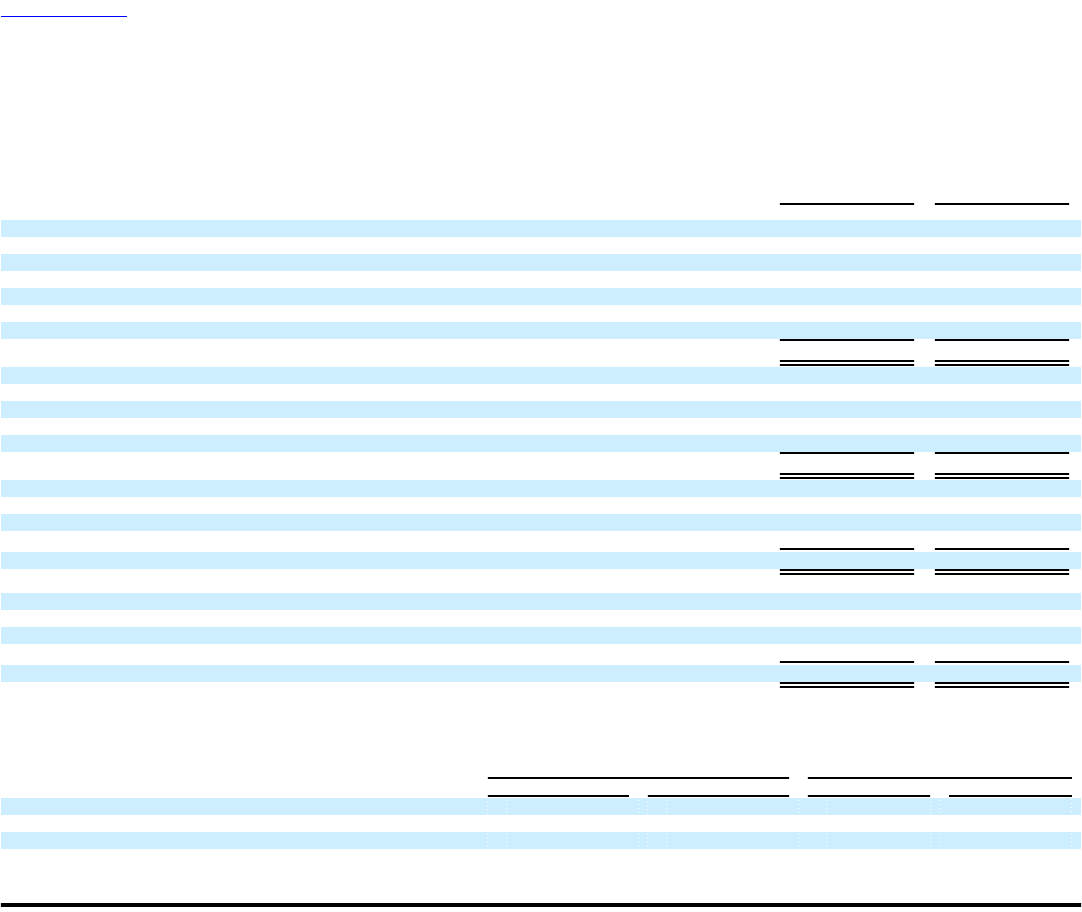

The projected benefit obligation and accumulated benefit obligation for both the defined benefit pension plan and the combined SERPs are in excess of the

fair value of plan assets. Following is a summary of the defined benefit pension plan and the combined SERPs:

Defined Benefit

Pension Plan Combined SERPs

2005 2004 2005 2004

Projected benefit obligation $ 143,280 $ 142,494 $ 59,240 $ 51,778

Accumulated benefit obligation 143,280 142,494 49,224 44,622

Fair value of plan assets 108,773 98,125 — —

F-33