MoneyGram 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

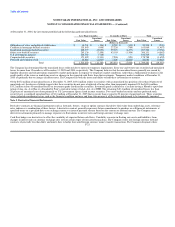

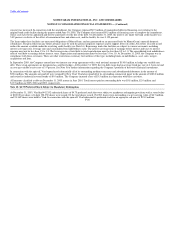

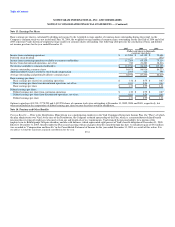

Note 13. Earnings Per Share

Basic earnings per share is calculated by dividing net income by the weighted average number of common shares outstanding during the period. As the

Company's common stock was not issued until June 30, 2004, the weighted average number of common shares outstanding for the first half of 2004 and all of

2003 represents Viad's historical weighted average number of common shares outstanding. The following table presents the calculation of basic and diluted

net income per share for the year ended December 31:

2005 2004 2003

(Dollars and shares in thousands,

except per share data)

Income from continuing operations $ 112,206 $ 65,129 $ 75,686

Preferred stock dividend — — (572)

Income from continuing operations available to common stockholders 112,206 65,129 75,114

Income from discontinued operations, net of tax 740 21,283 38,216

Net income available to common stockholders $ 112,946 $ 86,412 $ 113,330

Average outstanding common shares 84,675 86,916 86,223

Additional dilutive shares related to stock-based compensation 1,295 414 396

Average outstanding and potentially dilutive common shares 85,970 87,330 86,619

Basic earnings per share:

Basic earnings per share from continuing operations $ 1.32 $ 0.75 $ 0.87

Basic earnings per share from discontinued operations, net of tax 0.01 0.24 0.44

Basic earnings per share $ 1.33 $ 0.99 $ 1.31

Diluted earnings per share:

Diluted earnings per share from continuing operations $ 1.30 $ 0.75 $ 0.87

Diluted earnings per share from discontinued operations, net of tax 0.01 0.24 0.44

Diluted earnings per share $ 1.31 $ 0.99 $ 1.31

Options to purchase 403,210, 2,778,299 and 3,432,258 shares of common stock were outstanding at December 31, 2005, 2004 and 2003, respectively, but

were not included in the computation of diluted earnings per share because the effect would be antidilutive.

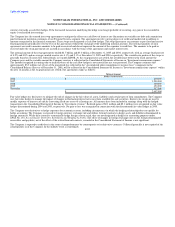

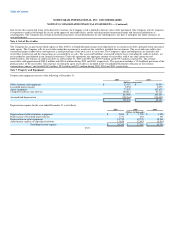

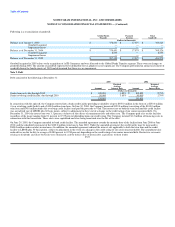

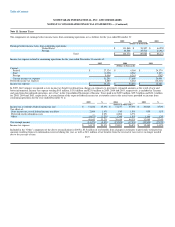

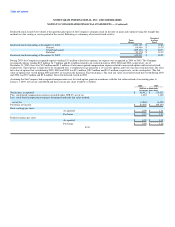

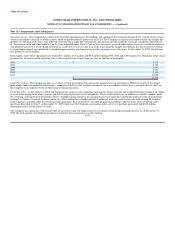

Note 14. Pensions and Other Benefits

Pension Benefits — Prior to the Distribution, MoneyGram was a participating employer in the Viad Companies Retirement Income Plan (the "Plan") of which

the plan administrator was Viad. At the time of the Distribution, the Company assumed sponsorship of the Plan, which is a noncontributory defined benefit

pension plan covering all employees who meet certain age and length-of-service requirements. Viad retained the pension liability for a portion of the

employees in its Exhibitgroup/ Giltspur subsidiary and one sold business, which represented eight percent of Viad's benefit obligation at December 31, 2003.

Effective December 31, 2003, benefits under the Plan ceased accruing with no change in benefits earned through this date. A curtailment gain of $3.8 million

was recorded in "Compensation and benefits" in the Consolidated Statement of Income for the year ended December 31, 2003 as a result of this action. It is

our policy to fund the minimum required contribution for the year. F-31