MasterCard 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

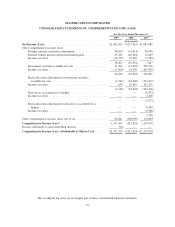

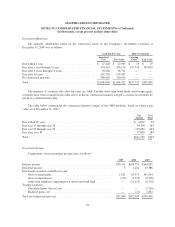

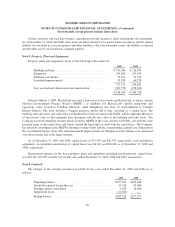

Note 3. Supplemental Cash Flows

The following table includes supplemental cash flow disclosures for each of the years ended December 31:

2009 2008 2007

Cash paid for income taxes1..................................... $457,285 $ 493,1991$ 561,860

Cash paid for interest .......................................... 10,569 14,058 17,094

Cash paid for legal settlements (Notes 19 and 21) .................... 945,530 1,263,185 113,925

Non-cash investing and financing activities:

Dividend declared but not yet paid ............................ 19,712 19,690 19,969

Municipal bonds cancelled .................................. 154,0002——

Revenue bonds received .................................... (154,000)3——

Building and land assets recorded pursuant to capital lease ......... (154,000)3——

Capital lease obligation ..................................... 154,0003——

Fair value of assets acquired, net of original investment, cash paid

and cash acquired ....................................... 16,970 124,275 —

Fair value of liabilities assumed related to investments in affiliates . . 14,792443,2345—

Fair value of non-controlling interest acquired ................... 8,015 — —

1$198,308 of these payments were recorded as an income tax receivable as of December 31, 2008.

2See Note 15 (Consolidation of Variable Interest Entity) for further details.

3See Note 8 (Property, Plant, and Equipment) for further details.

4Includes $8,750 to be extinguished in 2013 and 2016 for future benefits to be provided by MasterCard in the

establishment of a joint venture.

5Includes $20,432 due in 2011 relating to the MasterCard France acquisition.

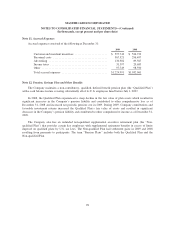

Note 4. Fair Value

Financial Instruments—Recurring Measurements

In accordance with accounting requirements for financial instruments, the Company is disclosing the

estimated fair values as of December 31, 2009 and 2008 of the financial instruments that are within the scope of

the accounting guidance, as well as the method(s) and significant assumptions used to estimate the fair value of

those financial instruments. Furthermore, the Company classifies its fair value measurements in the Valuation

Hierarchy.

The distribution of the fair values of the Company’s financial instruments which are measured at fair value

on a recurring basis within the Valuation Hierarchy is as follows:

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair Value at

December 31,

2009

Municipal bonds1................................ $ — $514,330 $ — $ 514,330

Taxable short-term bond funds ...................... 309,972 — — 309,972

Auction rate securities ............................ — — 179,987 179,987

Foreign currency forward contracts .................. — (1,274) — (1,274)

Other .......................................... 43 — — 43

Total .......................................... $310,015 $513,056 $179,987 $1,003,058

89