MasterCard 2009 Annual Report Download - page 101

Download and view the complete annual report

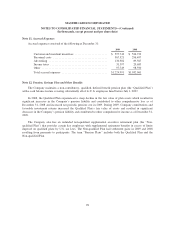

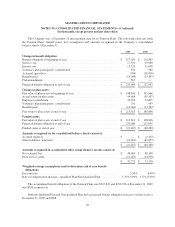

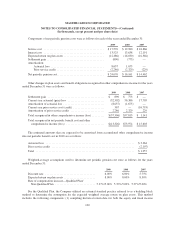

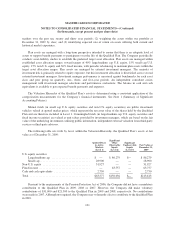

Please find page 101 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

Short-term and Long-term Debt

The Company estimates the fair value of its debt by applying a current discount rate to the remaining cash

flows under the terms of the debt. As of December 31, 2009 and 2008, the carrying values on the consolidated

balance sheets totaled $21,598 and $168,767, respectively. The fair values totaled $22,315 and $172,292 for the

Company’s debt as of December 31, 2009 and 2008, respectively. During 2009, the Company repaid $149,380 of

notes payable classified as short-term debt at December 31, 2008 related to its variable interest entity. See Note

15 (Consolidation of Variable Interest Entity) for further discussion.

Obligations Under Litigation Settlements

The Company estimates the fair values of its obligations under litigation settlements by applying a current

discount rate to the remaining cash flows under the terms of the litigation settlements. At December 31, 2009 and

2008, the carrying values on the consolidated balance sheet totaled $869,721 and $1,736,298, respectively, and

the fair values totaled $894,628 and $1,824,630, respectively, for these obligations. For additional information

regarding the Company’s obligations under litigation settlements, see Note 19 (Obligations Under Litigation

Settlements).

Settlement Guarantee Liabilities

The Company estimates the fair values of its settlement guarantees by applying market assumptions for

relevant though not directly comparable undertakings, as the latter are not observable in the market given the

proprietary nature of such guarantees. Additionally, loss probability and severity profiles against the Company’s

gross and net settlement exposures are considered. The carrying value and estimated fair value of settlement

guarantee liabilities were de minimis as of December 31, 2009 and 2008. For additional information regarding

the Company’s settlement guarantee liabilities, see Note 22 (Settlement and Travelers Cheque Risk

Management).

Refunding Revenue Bonds

The Company holds refunding revenue bonds with the same payment terms as, and which contain the right

of set-off with, a capital lease obligation related to the Company’s global technology and operations center

located in O’Fallon, Missouri, called Winghaven. The Company has netted the refunding revenue bonds and the

corresponding capital lease obligation in the consolidated balance sheet at December 31, 2009 and estimates that

the carrying value approximates the fair value for these bonds. See Note 8 (Property, Plant and Equipment) for

further details.

Non-Financial Instruments

Certain assets and liabilities are measured at fair value on a nonrecurring basis. The Company’s assets and

liabilities measured at fair value on a nonrecurring basis include property, plant and equipment, goodwill and

other intangible assets. These assets are not measured at fair value on an ongoing basis; however, they are subject

to fair value adjustments in certain circumstances, such as when there is evidence of impairment.

The valuation methods used in the impairment testing of goodwill and other intangible assets involve

assumptions concerning comparable company multiples, discount rates, growth projections and other

assumptions of future business conditions. As the assumptions employed to measure these assets on a

nonrecurring basis are based on management’s judgment using internal and external data, these fair value

determinations are classified in Level 3 of the Valuation Hierarchy.

91