MasterCard 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

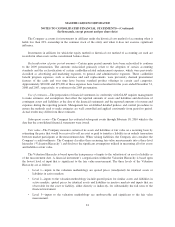

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

Additionally, accounting guidance was issued to highlight and expand on the factors that should be

considered in estimating fair value when there has been a significant decrease in market activity for a financial

asset. The new disclosures relate to fair value measurement inputs and valuation techniques (including changes in

inputs and valuation techniques). The Company adopted the changes, as required, during the second quarter of

2009 and the adoption had no impact on the Company’s financial position or results of operations. See Note 4

(Fair Value) for further detail.

Equity securities bought and held primarily for sale in the near term are classified as trading and are carried

at fair value. Net realized and unrealized gains and losses on trading securities are recognized in investment

income on the consolidated statements of operations. Equity securities not classified as trading are classified as

available-for-sale and are carried at fair value, with unrealized gains and losses, net of applicable taxes, recorded

as a separate component of other comprehensive income (loss) on the consolidated statements of comprehensive

income (loss). Net realized gains and losses on available-for-sale equity securities are recognized in investment

income on the consolidated statements of operations. The specific identification method is used to determine

realized gains and losses.

Available-for-sale equity securities are evaluated for other than temporary impairment on an ongoing basis.

If an investment is determined to be other than temporarily impaired, realized losses are recognized in investment

income on the consolidated statements of operations.

Settlement due from/due to customers—The Company operates systems for clearing and settling payment

transactions among MasterCard International members. Net settlements are generally cleared daily among

members through settlement cash accounts by wire transfer or other bank clearing means. However, some

transactions may not settle until subsequent business days, resulting in amounts due from and due to MasterCard

International members.

Restricted security deposits held for MasterCard International members—MasterCard requires and holds

cash deposits and certificates of deposit from certain members of MasterCard International as collateral for

settlement of their transactions. These assets are fully offset by corresponding liabilities included on the

consolidated balance sheets. However, the majority of collateral for settlement is typically in the form of standby

letters of credit and bank guarantees which are not recorded on the balance sheet.

Property, plant and equipment—Property, plant and equipment are stated at cost less accumulated

depreciation and amortization. Depreciation of equipment and furniture and fixtures is computed using the

straight-line method over the related estimated useful lives of the assets, generally ranging from two to five

years. Amortization of leasehold improvements is generally computed using the straight-line method over the

lesser of the estimated useful lives of the improvements or the terms of the related leases. Capital leases are

amortized using the straight-line method over the lives of the leases. Depreciation on buildings is calculated

using the straight-line method over an estimated useful life of 30 years. Amortization of leasehold improvements

and capital leases is included in depreciation expense.

The Company evaluates the recoverability of all long-lived assets whenever events or changes in

circumstances indicate that their carrying amount may not be recoverable. If the carrying value of the asset

cannot be recovered from estimated future cash flows, undiscounted and without interest, the fair value of the

asset is calculated using the present value of estimated net future cash flows. If the carrying amount of the asset

exceeds its fair value, an impairment is recorded.

Leases—The Company enters into operating and capital leases for the use of premises, software and equipment.

Rent expense related to lease agreements which contain lease incentives is recorded on a straight-line basis.

83