MasterCard 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

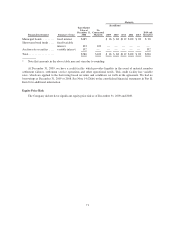

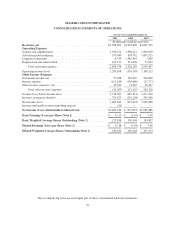

MASTERCARD INCORPORATED

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended December 31,

2009 2008 2007

(In thousands)

Operating Activities

Net income (loss) ............................................... $1,462,624 $ (253,915) $ 1,085,886

Adjustments to reconcile net income (loss) to net cash provided by operating

activities:

Depreciation and amortization ................................. 141,377 112,006 97,642

Gain on sale of Redecard S.A. available-for-sale securities ........... — (85,903) (390,968)

Share based payments (Note 17) ................................ 88,430 60,970 58,213

Stock units withheld for taxes .................................. (28,458) (67,111) (11,334)

Tax benefit for share based compensation ........................ (39,025) (47,803) (15,430)

Impairment of assets ......................................... 16,430 12,515 8,719

Accretion of imputed interest on litigation settlements .............. 86,342 77,202 38,046

Deferred income taxes ....................................... 336,704 (483,952) (5,492)

Other ..................................................... (12,121) 14,645 15,121

Changes in operating assets and liabilities:

Trading securities ....................................... — 2,561 9,700

Accounts receivable ..................................... 122,445 (115,687) (60,984)

Income taxes receivable .................................. 190,000 (198,308) —

Settlement due from customers ............................. 54,473 183,008 (356,305)

Prepaid expenses ........................................ (112,655) (100,853) (48,257)

Obligations under litigation settlement ....................... (938,685) 1,254,660 (110,525)

Accounts payable ....................................... 34,231 8,425 (30,650)

Settlement due to customers ............................... (65,628) (52,852) 276,144

Accrued expenses ....................................... 82,076 51,345 183,699

Net change in other assets and liabilities ..................... (40,398) 42,275 26,636

Net cash provided by operating activities ............................. 1,378,162 413,228 769,861

Investing Activities

Purchases of property, plant and equipment ....................... (56,563) (75,626) (81,587)

Capitalized software ......................................... (82,797) (94,647) (74,835)

Purchases of investment securities available-for-sale ................ (332,571) (519,514) (3,578,357)

Purchases of investment securities held-to-maturity ................ (300,000) — —

Proceeds from sales and maturities of investment securities

available-for-sale .......................................... 134,177 976,743 4,042,011

Acquisition of business, net of cash acquired ...................... (2,913) (81,731) —

Investment in affiliates ....................................... (17,709) — —

Other investing activities ..................................... (5,804) (3,574) 7,909

Net cash provided by (used in) investing activities ..................... (664,180) 201,651 315,141

Financing Activities

Purchase of treasury stock .................................... — (649,468) (600,532)

Payment of debt ............................................ (149,380) (80,000) —

Dividends paid ............................................. (78,685) (79,259) (74,002)

Exercise of stock options ..................................... 8,720 9,546 1,597

Tax benefit for share based compensation ........................ 39,025 47,803 15,430

Redemption of non-controlling interest .......................... (4,620) — —

Net cash used in financing activities ................................. (184,940) (751,378) (657,507)

Effect of exchange rate changes on cash and cash equivalents ............ 21,237 (17,636) 46,720

Net increase (decrease) in cash and cash equivalents .................... 550,279 (154,135) 474,215

Cash and cash equivalents—beginning of period ....................... 1,505,160 1,659,295 1,185,080

Cash and cash equivalents—end of period ............................ $2,055,439 $1,505,160 $ 1,659,295

The accompanying notes are an integral part of these consolidated financial statements.

77