MasterCard 2009 Annual Report Download - page 74

Download and view the complete annual report

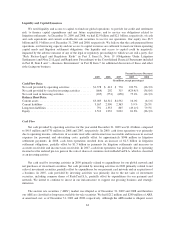

Please find page 74 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.call and redemption activity occurred periodically during 2009 and 2008. See Note 5 (Investment Securities) to

the consolidated financial statements included in Part II, Item 8 for more information.

Net cash used in financing activities in 2009, 2008 and 2007 included the payment of dividends and in 2009

and 2008 the repayment of $149 million and $80 million of debt, respectively. In addition, 2.8 million and

3.9 million shares of our Class A common stock acquired under share repurchase programs in 2008 and 2007

utilized approximately $650 million and $600 million, respectively. See Note 15 (Consolidation of Variable

Interest Entity), Note 14 (Debt) and Note 16 (Stockholders’ Equity) to the consolidated financial statements

included in Part II, Item 8 for more information on our debt repayments of $149 million and $80 million and the

stock repurchases, respectively.

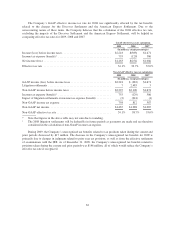

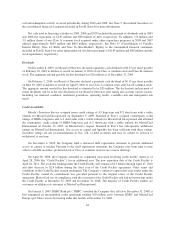

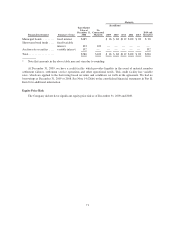

Dividends

On December 8, 2009, our Board of Directors declared a quarterly cash dividend of $0.15 per share payable

on February 10, 2010 to holders of record on January 8, 2010 of our Class A common stock and Class B common

stock. The aggregate amount payable for this dividend was $20 million as of December 31, 2009.

On February 2, 2010, our Board of Directors declared a quarterly cash dividend of $0.15 per share payable

on May 10, 2010 to holders of record on April 9, 2010 of our Class A common stock and Class B common stock.

The aggregate amount needed for this dividend is estimated to be $20 million. The declaration and payment of

future dividends will be at the sole discretion of our Board of Directors after taking into account various factors,

including our financial condition, settlement guarantees, operating results, available cash and anticipated cash

needs.

Credit Availability

Moody’s Investors Service assigned issuer credit ratings of A3 long-term and P-2 short-term with a stable

outlook for MasterCard Incorporated on September 9, 2009. Standard & Poor’s assigned counterparty credit

ratings of BBB+ long-term and A-2 short-term with a stable outlook for MasterCard Incorporated and affirmed

the counterparty credit ratings of BBB+ long-term and A-2 short-term with a stable outlook for MasterCard

International on October 13, 2009. At MasterCard’s request, Standard & Poor’s has subsequently withdrawn

ratings on MasterCard International. Our access to capital and liquidity has been sufficient with these ratings.

Securities ratings are not recommendations to buy, sell, or hold securities and may be subject to revision or

withdrawal at any time.

On November 4, 2009, the Company filed a universal shelf registration statement to provide additional

access to capital, if needed. Pursuant to the shelf registration statement, the Company may from time to time

offer to sell debt securities, preferred stock or Class A common stock in one or more offerings.

On April 28, 2008, the Company extended its committed unsecured revolving credit facility, dated as of

April 28, 2006 (the “Credit Facility”), for an additional year. The new expiration date of the Credit Facility is

April 26, 2011. The available funding under the Credit Facility will remain at $2.5 billion through April 27, 2010

and then decrease to $2.0 billion during the final year of the Credit Facility agreement. Other terms and

conditions in the Credit Facility remain unchanged. The Company’s option to request that each lender under the

Credit Facility extend its commitment was provided pursuant to the original terms of the Credit Facility

agreement. MasterCard was in compliance with the covenants of the Credit Facility and had no borrowings under

the Credit Facility at December 31, 2009 and December 31, 2008. The majority of Credit Facility lenders are

customers or affiliates of customers of MasterCard International.

On January 5, 2009, HSBC Bank plc (“HSBC”) notified the Company that, effective December 31, 2008, it

had terminated an uncommitted credit agreement totaling 100 million euros between HSBC and MasterCard

Europe sprl. There was no borrowing under this facility at December 31, 2008.

64