MasterCard 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 MasterCard Annual Report 2009

MasterCard-enabled phones allow users to manage accounts,

pay bills, and, with the addition of PayPass capabilities, to make

purchases at participating merchants and points of sale. On the

commercial side, we launched a commercial mobile PayPass program

in Korea with LG U+ and Shinhan Card. The phones contain a

PayPass chip card that allows them to be used not only for contactless

payment transactions, but as a contactless travel pass and for

identifi cation purposes.

At the same time, our person-to-person (P2P) MasterCard

MoneySend®

platform makes it easier than ever to transfer funds to

family and friends, whether across the street or across borders, in

17 countries. Through phones, the Internet, and ATMs, our innovative

P2P solutions are advancing worldwide, allowing cardholders to make

account-to-card and card-to-card transfers in seconds. P2P options

are a particular boon in an age of an increasingly global workforce,

allowing workers to send money home instantly, while avoiding the

hassle and expense of checks, money orders, and wire transfers.

Our penchant for innovation extends to programs for large

companies and small businesses as well — one reason we’ve been

named the world’s top corporate card and expense management

provider by Global Finance magazine. Throughout the economic

downturn, controlling costs has been top of mind for every company.

Our response: to work closely with both customers and merchants

to develop programs that help companies manage spending while

enjoying savings and rewards. One example includes the MasterCard

Easy Savings®

Program for Small Business, which enables companies

in Canada, the U.S., and the U.K. to save on a wide range of goods

and services. MasterCard inControl, meanwhile, helps companies

manage spending.

We’re also committed to helping customers control costs and ensure

cardholder confi dence by providing Expert Monitoring Solutions,

a highly advanced suite of fraud prevention products. By enabling

fi nancial institutions to identify fraud before it happens, MasterCard

is delivering added value to customers and protecting cardholders.

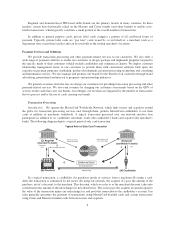

Insights That Drive Tailored Payments Solutions

MasterCard also leads the way as a primary source of actionable

insights and intelligence leveraged by issuers, merchants, and

governments in markets worldwide. Based on a wealth of data, our

insights are delivered through information services, data analytics, and

MasterCard Advisors®

, our unique professional services organization.

Among our reports, the most widely followed is MasterCard Advisors’

SpendingPulse®

. SpendingPulse offers timely views of spending on

everything from gasoline to apparel and has become vital to

understanding consumer trends and behavior in the U.S. and the

U.K. In addition, earlier this year, we launched MasterCard Advisors’

Merchant Solutions, a new offering that is squarely focused on helping

merchants improve performance.

Aside from creating a deeper and broader understanding of

economic trends, our insights drive the development of targeted,

Innovation: Advancing

New Ways to Make Payments

We continue to make investments in innovative

products and solutions that are shaping the

future of payments. Among the highlights:

• Mobile: Our 2009 launch of the MasterCard

Mobile Payments Gateway allowed banks

and mobile network operators in emerging

markets to advance payments via mobile

phones and included game-changing mobile

P2P money transfers. In Brazil, for example, we

are working to enable consumers to link their

mobile phones to MasterCard and Maestro

credit and debit accounts. At the same time,

in developed markets, our MoneySend P2P

money transfer functionality was expanded,

allowing consumers to transfer funds between

any type of MasterCard or Maestro cards.

• inControl: Our development and launch of

MasterCard inControl™ represents a leading

innovation in cardholder empowerment.

The inControl platform helps consumers and

corporations manage spending on credit and

debit cards by determining when, where,

how, and for what purpose the cards can be

used. A number of fi nancial institutions in

Europe and the U.S. are already offering this

functionality. With cost control now top of

mind for just about everyone, MasterCard

inControl is a timely, convenient solution that

addresses today’s cardholder needs.

• Prepaid: Social Security recipients can

now receive benefi ts from the U.S. Treasury

Department more effi ciently thanks to

MasterCard Direct Express prepaid cards

issued by Comerica. In 2010, this program

reached the one-million card milestone.

On the corporate side, MasterCard worked

with Walmart Stores Inc., one of the largest

employers, to provide prepaid payroll cards

to their Walmart and Sam’s Club associates

in the U.S. Finally, on the consumer side, we

partnered with Univision to introduce

a prepaid card that gives the U.S.

Hispanic community a safe and

cost-effective alternative

to cash.

i

n

th

e

U

.

S

.

Fi

na

lly

, on

th

e consumer s

id

par

tnered with Univision to int

a prepaid card that

g

ives th

e

His

pan

ic commun

ity

a s

a

cost

-

e

ffe

ct

iv

e

a

l

te

rn

a

to

cas

h

.