MasterCard 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

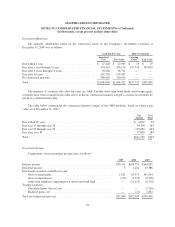

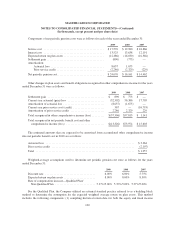

Note 11. Accrued Expenses

Accrued expenses consisted of the following at December 31:

2009 2008

Customer and merchant incentives ....................... $ 597,742 $ 526,722

Personnel costs ...................................... 367,321 296,497

Advertising ......................................... 130,582 89,567

Income taxes ........................................ 31,597 20,685

Other .............................................. 97,749 98,590

Total accrued expenses ................................ $1,224,991 $1,032,061

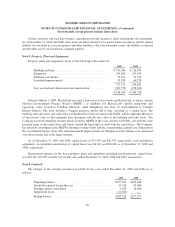

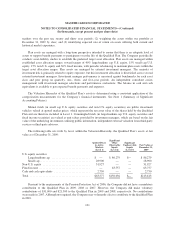

Note 12. Pension, Savings Plan and Other Benefits

The Company maintains a non-contributory, qualified, defined benefit pension plan (the “Qualified Plan”)

with a cash balance feature covering substantially all of its U.S. employees hired before July 1, 2007.

In 2008, the Qualified Plan experienced a steep decline in the fair value of plan assets which resulted in

significant increases in the Company’s pension liability and contributed to other comprehensive loss as of

December 31, 2008 and increased net periodic pension cost in 2009. During 2009, Company contributions and

favorable investment returns increased the Qualified Plan’s fair value of assets and resulted in significant

decreases in the Company’s pension liability and contributed to other comprehensive income as of December 31,

2009.

The Company also has an unfunded non-qualified supplemental executive retirement plan (the “Non-

qualified Plan”) that provides certain key employees with supplemental retirement benefits in excess of limits

imposed on qualified plans by U.S. tax laws. The Non-qualified Plan had settlement gains in 2009 and 2008

resulting from payments to participants. The term “Pension Plans” includes both the Qualified Plan and the

Non-qualified Plan.

98