MasterCard 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 MasterCard Annual Report 2009

Dear Fellow Shareholders:

We are very pleased with the results MasterCard delivered in 2009 and in the fi rst quarter

of 2010, particularly in light of the challenging economic environment. Even more importantly,

we are confi dent in the opportunities that lie ahead. We are in an excellent position to write

a new chapter in our company’s history as we drive innovation at the heart of commerce and

deliver value to societies in markets worldwide.

As economic trends and events reshape the payments landscape, prospects are favorable. Emerging markets offer tremendous

opportunities; technological advances are driving new and innovative product ideas; and, the secular trend toward electronic

payments continues to gather force. Worldwide, consumers, businesses, and even governments are demanding safer, faster,

easier, more controllable, and more rewarding payment alternatives.

In this era of change, we’re committed to leveraging our strengths, insights, and integrated solutions to drive innovation —

and to advance commerce for everyone, everywhere.

Solid Performance and a World of Opportunities

Throughout 2009, we focused our attention on reducing expenses, improving margins, and realigning our resources to

capitalize on the most promising geographic and market opportunities. These actions enabled us to achieve solid results

despite the challenging environment.

Around the world the payments industry offers tremendous growth potential. In the United States — our most established

market — opportunities continue to emerge, particularly in prepaid, e-commerce, and debit.

Markets in Africa, Asia, Canada, Europe, Latin America, and the Middle East

offer even greater potential, so we’ve positioned ourselves to make the most

of those growing opportunities. Already, more than half of our revenues are

generated outside the U.S. In the years ahead, we fully expect to continue

growing, not only in markets where electronic payments are in their infancy,

but in developed, underpenetrated markets in many parts of the world.

An Advanced Global Network; World-Renowned Brands

In enumerating our strengths, it’s fi tting to start with the MasterCard

Worldwide Network.

In 2009, our network processed over 22 billion transactions, a nearly

7 percent rise over 2008. This growth was achieved with a high degree

of accuracy, reliability, and security, as well as the fl exibility to enable our

customers to deliver custom-tailored products to cardholders worldwide.

Our payments network is unique in the industry in that it seamlessly

blends the speed and reliability of a distributed network with the real-time

availability and cardholder-level processing of a centralized network.

By dynamically adapting to the needs of each transaction, our network

helps customers control their operational and fraud-related costs. At the

same time, it enables growth through portfolio differentiation, as well as

emerging markets and payment technologies.

In addition, we continually invest in ways to strategically expand our

processing capabilities in the payments value chain. In 2008, we

introduced MasterCard Integrated Processing Solutions (IPS), a

MasterCard-engineered issuer processing platform designed to provide

global customers with a complete processing solution. IPS helps create

differentiated products and services and allows quick deployment of

Executive Letter

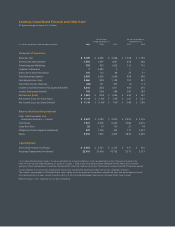

$5.1B

$1.5B

44.3%

$2.5T

22B

966M

659M

1.6B

Net Income

Operating

Margin

Gross Dollar

Volume

Processed

Transactions

MasterCard-

Branded Credit

and Debit Cards*

Maestro Cards*

Total Cards*

Net Revenue

Key 2009 Highlights

T=Trillion, B=Billion, M=Million

*As of December 31, 2009