MasterCard 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

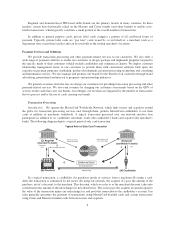

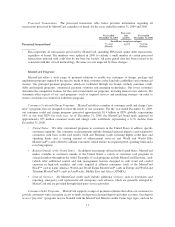

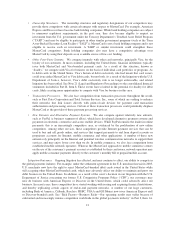

Processed Transactions. The processed transaction table below provides information regarding all

transactions processed by MasterCard, regardless of brand, for the years ended December 31, 2009 and 2008

Year ended

December 31, 2009

Year-over-

year

growth

Year ended

December 31, 2008

(In millions, except percentages)

Processed transactions1............................... 22,410 6.9% 20,954

1Data represents all transactions processed by MasterCard, including PIN-based online debit transactions,

regardless of brand. The numbers were updated in 2009 to exclude a small number of certain processed

transactions initiated with cards that do not bear our brands. All prior period data has been revised to be

consistent with this revised methodology. Revenue was not impacted by these changes.

MasterCard Programs

MasterCard offers a wide range of payment solutions to enable our customers to design, package and

implement programs targeted to the specific needs of their customers (which include cardholders and commercial

clients). Our principal payment programs, which are facilitated through our brands, include consumer credit,

debit and prepaid programs, commercial payment solutions and emerging technologies. Our issuer customers

determine the competitive features for the cards issued under our programs, including interest rates and fees. We

determine other aspects of our card programs—such as required services and marketing strategy—in order to

ensure consistency in connection with these programs.

Consumer Credit and Charge Programs. MasterCard offers a number of consumer credit and charge (“pay

later”) programs that are designed to meet the needs of our customers. For the year ended December 31, 2009,

our consumer credit and charge programs generated approximately $1.4 trillion in GDV globally, representing

59% of our total GDV for such year. As of December 31, 2009, the MasterCard brand mark appeared on

approximately 675 million consumer credit and charge cards worldwide, representing a 6.7% decline from

December 31, 2008.

•United States. We offer customized programs to customers in the United States to address specific

consumer segments. Our consumer credit programs include Standard (general purpose cards targeted to

consumers with basic credit card needs), Gold and Platinum (cards featuring higher credit lines and

spending limits and a varying amount of enhancement services) and World and World Elite

MasterCard®(cards offered to affluent consumers which feature no required preset spending limit and a

revolving option).

•Regions Outside of the United States. In addition to programs offered in the United States, MasterCard

makes available to customers outside of the United States a variety of consumer card programs in

selected markets throughout the world. Examples of such programs include MasterCard Electronic cards

(which offer additional control and risk management features designed to curb fraud and control

exposure in high risk markets) and cards targeted at affluent consumers (such as the MasterCard

Black™ card in Latin America, World and World Signia MasterCard®cards in Europe and World and

Titanium MasterCard™ cards in Asia/Pacific, Middle East and Africa (APMEA).

•General Services. All MasterCard credit cards include additional services, such as lost/stolen card

reporting, emergency card replacement and emergency cash advance, which are generally arranged by

MasterCard and are provided through third-party service providers.

Consumer Debit Programs. MasterCard supports a range of payment solutions that allow our customers to

provide consumers with convenient access to funds on deposit in demand deposit and other accounts. Our deposit

access (“pay now”) programs may be branded with the MasterCard, Maestro and/or Cirrus logo types, and can be

11