MasterCard 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

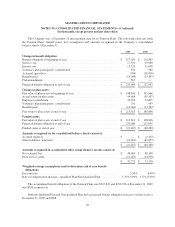

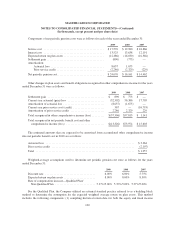

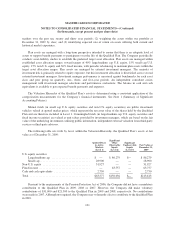

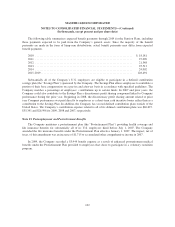

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

basis into shares of Class A common stock for subsequent sale or transfer to public investors, beginning after

May 31, 2010. The conversion programs follow the expiration on May 31, 2010 of a 4-year post-IPO restriction

period with respect to the conversion of shares of Class B common stock. The Company currently expects that

the first 2010 conversion program will consist of four one-week periods in June 2010. Holders of shares of Class

B common stock will be able to make conversion elections in a program to be modeled on the Company’s 2008

and 2009 programs, except that there will not be a limit on the number of shares of Class B common stock that

are eligible for conversion by any one holder. Starting in early July 2010, the Company expects to run a

subsequent, continuous conversion program for remaining shares of Class B common stock, featuring an “open

window” for elections of any size.

Additionally, if at any time while shares of Class M common stock are outstanding, the number of shares of

Class B common stock outstanding is less than 41% of the aggregate number of shares of Class A common stock

and Class B common stock outstanding, Class B stockholders will in certain circumstances be permitted to

acquire an aggregate number of shares of Class A common stock in the open market or otherwise, with acquired

shares thereupon converting into an equal number of shares of Class B common stock so that holders of Class B

common stock could own up to 41% of the aggregate number of shares of Class A common stock and Class B

common stock outstanding at such time. Shares of Class B common stock are non-registered securities that may

be bought and sold among eligible holders of Class B common stock subject to certain limitations.

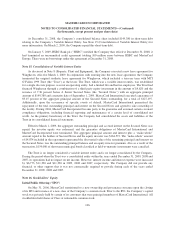

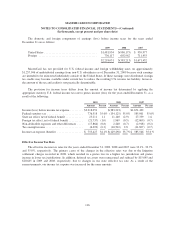

Stock Repurchase Program

In April 2007, the Company’s Board of Directors authorized a plan for the Company to repurchase up to

$500,000 of its Class A common stock in open market transactions during 2007. On October 29, 2007, the

Company’s Board of Directors amended the share repurchase plan to authorize the Company to repurchase an

incremental $750,000 (aggregate for the entire repurchase program of $1,250,000) of its Class A common stock

in open market transactions through June 30, 2008. As of December 31, 2007, approximately 3,922 shares of

Class A common stock had been repurchased at a cost of $600,532. During 2008, the Company repurchased

approximately 2,819 shares of Class A common stock at a cost of $649,468, completing its aggregate authorized

share repurchase program of $1,250,000. The Company records the repurchase of shares of common stock at cost

based on the settlement date of the transaction. These shares are classified as treasury stock, which is a reduction

to stockholders’ equity. Treasury stock is included in authorized and issued shares but excluded from outstanding

shares.

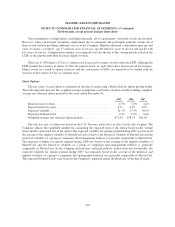

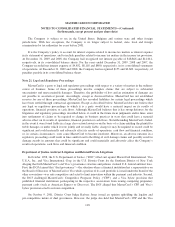

Note 17. Share Based Payment and Other Benefits

In May 2006, the Company implemented the MasterCard Incorporated 2006 Long-Term Incentive Plan (the

“LTIP”). The LTIP is a shareholder-approved omnibus plan that permits the grant of various types of equity

awards to employees.

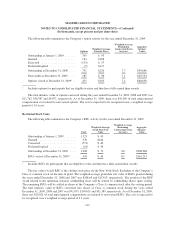

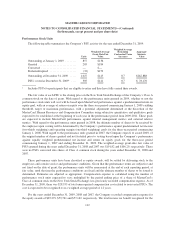

The Company has granted restricted stock units (“RSUs”), non-qualified stock options (“options”) and

Performance Stock Units (“PSUs”) under the LTIP. The RSUs generally vest after three to four years. The

options, which expire ten years from the date of grant, generally vest ratably over four years from the date of

grant. The PSUs generally vest after three years. Additionally, the Company made a one-time grant to all

non-executive management employees upon the IPO for a total of approximately 440 RSUs (the “Founders’

Grant”). The Founders’ Grant RSUs vested three years from the date of grant. The Company uses the straight-

line method of attribution for expensing equity awards. Compensation expense is recorded net of estimated

forfeitures. Estimates are adjusted as appropriate.

109