MasterCard 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Regional and domestic/local PIN-based debit brands are the primary brands in many countries. In these

markets, issuers have historically relied on the Maestro and Cirrus brands (and other brands) to enable cross-

border transactions, which typically constitute a small portion of the overall number of transactions.

In addition to general purpose cards, private label cards comprise a portion of all card-based forms of

payment. Typically, private label cards are “pay later” cards issued by, or on behalf of, a merchant (such as a

department store or gasoline retailer) and can be used only at the issuing merchant’s locations.

Payment Services and Solutions

We provide transaction processing and other payment-related services to our customers. We also offer a

wide range of payment solutions to enable our customers to design, package and implement programs targeted to

the specific needs of their customers (which include cardholders and commercial clients). We deploy customer

relationship management teams to our customers to provide them with customized solutions built upon our

expertise in payment programs, marketing, product development, payment processing technology and consulting

and information services. We also manage and promote our brands for the benefit of all customers through brand

advertising, promotional and interactive programs and sponsorship initiatives.

We generate revenues from the fees we charge our customers for providing transaction processing and other

payment-related services. We also earn revenues by charging our customers assessments based on the GDV of

activity on the cards that carry our brands. Accordingly, our revenues are impacted by the number of transactions

that we process and by the use of cards carrying our brands.

Transaction Processing

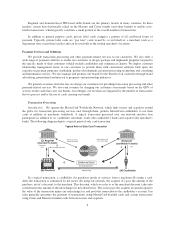

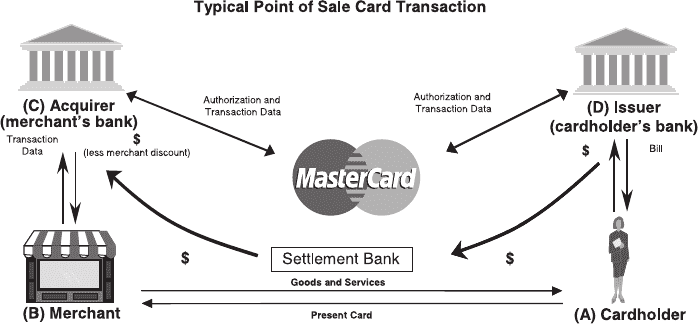

Introduction. We operate the MasterCard Worldwide Network, which links issuers and acquirers around

the globe for transaction processing services and, through them, permits MasterCard cardholders to use their

cards at millions of merchants worldwide. A typical transaction processed over our network involves four

participants in addition to us: cardholder, merchant, issuer (the cardholder’s bank) and acquirer (the merchant’s

bank). The following diagram depicts a typical point-of-sale card transaction.

In a typical transaction, a cardholder (A) purchases goods or services from a merchant (B) using a card.

After the transaction is authorized by the issuer (D) using our network, the acquirer (C) pays the amount of the

purchase, net of a discount, to the merchant. This discount, which we refer to as the merchant discount, takes into

consideration the amount of the interchange fee described below. The issuer pays the acquirer an amount equal to

the value of the transaction minus any interchange fee and posts the transaction to the cardholder’s account. Our

rules generally guarantee the payment of transactions using MasterCard-branded cards and certain transactions

using Cirrus and Maestro-branded cards between issuers and acquirers.

6