MasterCard 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Forward-Looking Statements

This Report on Form 10-K contains forward-looking statements pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. When used in this Report, the words “believe,” “expect,”

“could,” “may,” “would”, “will” and similar words are intended to identify forward-looking statements. These

forward-looking statements relate to the Company’s future prospects, developments and business strategies and

include, without limitation, the Company’s belief in the continuing trend from paper-based forms of payment

toward electronic forms of payment and its ability to drive growth by: further penetrating its existing customer

base and by expanding its role in targeted geographies and higher-growth segments of the global payments

industry, pursuing domestic processing opportunities throughout the world and building relationships to expand

such opportunities, enhancing its relationships with merchants, expanding points of acceptance for its brands,

seeking to maintain unsurpassed acceptance and continuing to invest in its brands, pursuing incremental payment

opportunities throughout the world, increasing its volume of business with customers over time, expanding its

processing capabilities in the payment value chain (including continuing to develop opportunities to further

enhance its Integrated Processing Solutions (“IPS”) offerings and expanding capabilities through the

development of strategic alliances), maintaining a strong business presence in Europe as well as effectively

positioning the business as the Single European Payment Area (“SEPA”) initiative creates a more open and

competitive payment market in many European countries and increasing global MasterCard brand awareness

preference and usage through integrated advertising, sponsorship and related activities on a global scale. Many

factors and uncertainties relating to our operations and business environment, all of which are difficult to predict

and many of which are outside of our control, influence whether any forward-looking statements can or will be

achieved. Any one of those factors could cause our actual results to differ materially from those expressed or

implied in writing in any forward-looking statements made by MasterCard or on its behalf. We believe there are

certain risk factors that are important to our business, and these could cause actual results to differ from our

expectations. Please see a complete discussion of these risk factors in Part I, Item 1A—Risk Factors.

In this Report, references to the “Company,” “MasterCard,” “we,” “us” or “our” refer to the MasterCard

brand generally, and to the business conducted by MasterCard Incorporated and its consolidated subsidiaries,

including our principal operating subsidiary, MasterCard International Incorporated (d/b/a MasterCard

Worldwide).

Item 1. Business

Overview

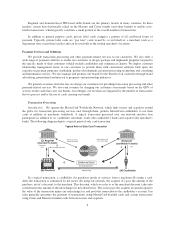

MasterCard is a leading global payment solutions company that provides a variety of services in support of

the credit, debit and related payment programs of approximately 23,000 financial institutions and other entities

that are our customers. Through our three-tiered business model as franchisor, processor and advisor, we develop

and market payment solutions, process payment transactions, and provide support services to our customers and,

depending upon the service, to merchants and other clients. We manage a family of well-known, widely accepted

payment card brands, including MasterCard®, MasterCard Electronic™, Maestro®and Cirrus®, which we license

to our customers. As part of managing these brands, we also establish and enforce rules and standards

surrounding the use of our payment card network. MasterCard generates revenue by charging fees to our

customers for providing transaction processing and other payment-related services and assessing our customers

based on the dollar volume of activity on the cards that carry our brands.

A typical transaction processed over our network involves four parties in addition to us: the cardholder, the

merchant, the issuer (the cardholder’s bank) and the acquirer (the merchant’s bank). Consequently, the payment

network we operate supports what is often referred to as a “four-party” payment system. Our customers are the

financial institutions and other entities that act as issuers and acquirers. Using our transaction processing

services, issuers and acquirers facilitate payment transactions between cardholders and merchants throughout the

world, providing merchants with an efficient and secure means of receiving payment, and consumers and

businesses with a convenient, quick and secure payment method that is accepted worldwide. We guarantee the

settlement of many of these transactions among our customers to ensure the integrity of our payment network. In

addition, we undertake a variety of marketing activities designed to maintain and enhance the value of our

brands. However, cardholder and merchant transaction relationships are managed principally by our customers.

3