MasterCard 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

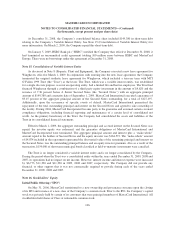

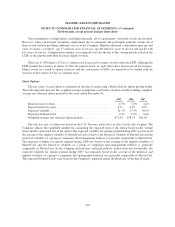

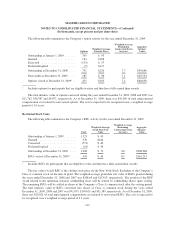

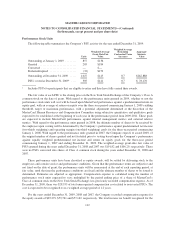

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

which have been classified as investment securities held-to-maturity. The agreements enabled MasterCard to

secure state and local financial benefits. No gain or loss was recorded in connection with the agreements. The

leaseback has been accounted for as a capital lease as the agreement contains a bargain purchase option at the end

of the ten-year lease term on April 1, 2013. The building and related equipment are being depreciated over their

estimated economic life in accordance with the Company’s policy. Rent of $1,819 is due annually and is equal to

the interest due on the municipal bonds. The future minimum lease payments are $43,962 and are included in the

table above. A portion of the building was subleased to the original building owner for a five-year term with a

renewal option. As of December 31, 2009, the future minimum sublease rental income is $3,312.

Note 19. Obligations Under Litigation Settlements

On October 27, 2008, MasterCard and Visa Inc. (“Visa”) entered into a settlement agreement (the “Discover

Settlement”) with Discover Financial Services, Inc. (“Discover”) relating to the U.S. federal antitrust litigation

amongst the parties. The Discover Settlement ended all litigation among the parties for a total of $2,750,000. In

July 2008, MasterCard and Visa had entered into a judgment sharing agreement that allocated responsibility for

any judgment or settlement of the Discover action among the parties. Accordingly, the MasterCard share of the

Discover Settlement was $862,500, which was paid to Discover in November 2008. In addition, in connection

with the Discover Settlement, Morgan Stanley, Discover’s former parent company, paid MasterCard $35,000 in

November 2008, pursuant to a separate agreement. The net impact of $827,500 is included in litigation

settlements for the year ended December 31, 2008.

On June 24, 2008, MasterCard entered into a settlement agreement (the “American Express Settlement”)

with American Express Company (“American Express”) relating to the U.S. federal antitrust litigation between

MasterCard and American Express. The American Express Settlement ended all existing litigation between

MasterCard and American Express. Under the terms of the American Express Settlement, MasterCard is

obligated to make 12 quarterly payments of up to $150,000 per quarter beginning in the third quarter of 2008.

MasterCard’s maximum nominal payments will total $1,800,000. The amount of each quarterly payment is

contingent on the performance of American Express’s U.S. Global Network Services business. The quarterly

payments will be in an amount equal to 15% of American Express’s U.S. Global Network Services billings

during the quarter, up to a maximum of $150,000 per quarter. If, however, the payment for any quarter is less

than $150,000, the maximum payment for subsequent quarters will be increased by the difference between

$150,000 and the lesser amount that was paid in any quarter in which there was a shortfall. MasterCard assumes

American Express will achieve these financial hurdles. MasterCard recorded the present value of $1,800,000, at a

5.75% discount rate, or $1,649,345 for the year ended December 31, 2008. As of December 31, 2009, the

Company has six quarterly payments for a total of $900,000 remaining.

In 2003, MasterCard entered into a settlement agreement (the “U.S. Merchant Lawsuit Settlement”) related

to the U.S. merchant lawsuit described under the caption “U.S. Merchant and Consumer Litigations” in Note 21

(Legal and Regulatory Proceedings) and contract disputes with certain customers. Under the terms of the U.S.

Merchant Lawsuit Settlement, the Company was required to pay $125,000 in 2003 and $100,000 annually each

December from 2004 through 2012. On July 1, 2009, MasterCard entered into an agreement (the “Prepayment

Agreement”) with plaintiffs of the U.S. Merchant Lawsuit Settlement whereby MasterCard agreed to make a

prepayment of its remaining $400,000 in payment obligations at a discounted amount of $335,000 on

September 30, 2009. The Company made the prepayment at the discounted amount of $335,000 on

September 30, 2009, after the Prepayment Agreement became final. In addition, in 2003, several other lawsuits

were initiated by merchants who opted not to participate in the plaintiff class in the U.S. merchant lawsuit. The

“opt-out” merchant lawsuits were not covered by the terms of the U.S. Merchant Lawsuit Settlement and all have

been individually settled.

114