MasterCard 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

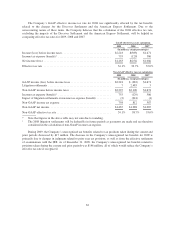

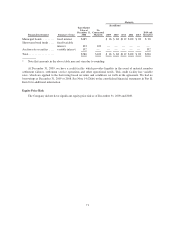

The Company’s GAAP effective income tax rate for 2008 was significantly affected by the tax benefits

related to the charges for the Discover Settlement and the American Express Settlement. Due to the

non-recurring nature of these items, the Company believes that the calculation of the 2008 effective tax rate,

excluding the impacts of the Discover Settlement and the American Express Settlement, will be helpful in

comparing effective tax rates for 2009, 2008 and 2007.

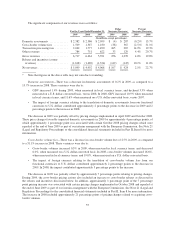

GAAP effective tax rate calculation

2009 2008 2007

(In millions, except percentages)

Income (loss) before income taxes .................................. $2,218 $(383) $1,671

Income tax expense (benefit)1..................................... 755 (129) 586

Net income (loss) ............................................... $1,463 $(254) $1,086

Effective tax rate ............................................... 34.1% 33.7% 35.0%

Non-GAAP effective tax rate calculation

2009 2008 2007

(In millions, except percentages)

GAAP income (loss) before income taxes ............................ $2,218 $ (383) $1,671

Litigation settlements ............................................ 7 2,483 3

Non-GAAP income before income taxes ............................. $2,225 $2,100 $1,674

Income tax expense (benefit)1..................................... 755 (129) 586

Impact of litigation settlements on income tax expense (benefit) .......... (2) (941) (1)

Non-GAAP income tax expense ................................... 758 812 587

Non-GAAP net income .......................................... $1,467 $1,288 $1,087

Non-GAAP effective tax rate ...................................... 34.1% 38.7% 35.0%

* Note that figures in the above table may not sum due to rounding.

1The 2008 litigation settlements will be deductible in future periods as payments are made and are therefore

considered in the calculation of non-GAAP income tax expense.

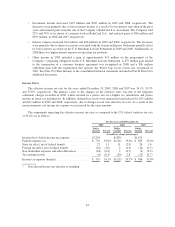

During 2009, the Company’s unrecognized tax benefits related to tax positions taken during the current and

prior periods decreased by $17 million. The decrease in the Company’s unrecognized tax benefits for 2009 is

primarily due to changes in judgment related to prior year tax positions, as well as from the effective settlement

of examinations with the IRS. As of December 31, 2009, the Company’s unrecognized tax benefits related to

positions taken during the current and prior periods was $146 million, all of which would reduce the Company’s

effective tax rate if recognized.

62