MasterCard 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

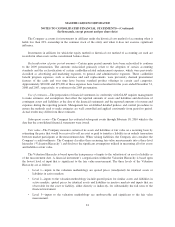

payment-related services are dependent on the nature of the products or services provided to our customers and

are recognized as revenue in the same period as the related transactions occur or services are rendered.

MasterCard has business agreements with certain customers that provide for fee rebates when the customers

meet certain volume hurdles as well as other support incentives such as marketing, which are tied to

performance. Rebates and incentives are recorded as a reduction of revenue in the same period as the revenue is

earned or performance has occurred. Rebates and incentives are calculated on a monthly basis based upon

estimated performance and the terms of the related business agreements. In addition, MasterCard may incur costs

directly related to the acquisition of the contract, which are deferred and amortized over the life of the contract.

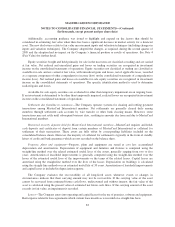

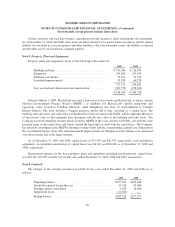

Pension and other postretirement plans—Compensation cost of an employee’s pension benefit is

recognized in general and administrative expenses on the projected unit credit method over the employee’s

approximate service period. The unit credit cost method is utilized for funding purposes.

The Company recognizes the overfunded or underfunded status of its single-employer defined benefit plan

or postretirement plan as an asset or liability in its balance sheet and recognizes changes in the funded status in

the year in which the changes occur through comprehensive income. The Company also measures the funded

status of a plan as of the date of its year-end balance sheet.

The accounting disclosure standards for employers’ disclosures about postretirement benefit plan assets

were amended and became effective for the Company in 2009. These new standards provide guidance on an

employer’s disclosures about plan assets of a defined benefit pension plan or other postretirement plan, including

disclosure of how investment allocation decisions are made, major categories of plan assets, inputs and valuation

techniques used to measure the fair value of plan assets and concentrations of credit risk. The Company adopted

the guidance in 2009, as required, and the adoption had no impact on the Company’s financial position or results

of operations. See Note 12 (Pension, Savings Plan and Other Benefits) for further detail.

Share based payments—The Company recognizes the fair value of all share-based payments to employees

in its financial statements. The Company recognizes a realized tax benefit associated with dividends on certain

equity shares and options as an increase to additional paid-in capital. The benefit is included in the pool of excess

tax benefits available to absorb potential future tax liabilities on share based payment awards.

Advertising expense—Cost of media advertising is expensed when the advertising takes place. Production

costs are expensed as costs are incurred. Promotional items are expensed at the time the promotional event

occurs. Sponsorship costs are recognized over the period of benefit based on the estimated value of certain

events.

Foreign currency translation—The U.S. dollar is the functional currency for the majority of the Company’s

businesses except for MasterCard Europe’s operations, for which the functional currency is the euro, and

MasterCard’s operations in Brazil, for which the functional currency is the real. Where the U.S. dollar is

considered the functional currency, monetary assets and liabilities are re-measured to U.S. dollars using current

exchange rates in effect at the balance sheet date; non-monetary assets and liabilities are re-measured at historical

exchange rates; and revenue and expense accounts are re-measured at a weighted average exchange rate for the

period. Resulting exchange gains and losses and transactional foreign exchange gains and losses are included in

general and administrative expenses in the statement of operations. Where local currency is the functional

currency, translation from the local currency to U.S. dollars is performed for balance sheet accounts using current

exchange rates in effect at the balance sheet date and for revenue and expense accounts using a weighted average

exchange rate for the period. Resulting translation adjustments are reported as a component of other

comprehensive income (loss).

86