MasterCard 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity and Capital Resources

We need liquidity and access to capital to fund our global operations; to provide for credit and settlement

risk; to finance capital expenditures and any future acquisitions; and to service our obligations related to

litigation settlements. At December 31, 2009 and 2008, we had $2.9 billion and $2.1 billion, respectively, of cash

and cash equivalents and current available-for-sale securities to use for our operations. Our equity was $3.5

billion and $1.9 billion as of December 31, 2009 and 2008, respectively. We believe that the cash generated from

operations, our borrowing capacity and our access to capital resources are sufficient to meet our future operating

capital needs and litigation settlement obligations. Our liquidity and access to capital could be negatively

impacted by the adverse outcome of any of the legal or regulatory proceedings to which we are still a party. See

“Risk Factors-Legal and Regulatory Risks” in Part I, Item 1A, Note 19 (Obligations Under Litigation

Settlements) and Note 21 (Legal and Regulatory Proceedings) to the Consolidated Financial Statements included

in Part II, Item 8 and “—Business Environment” in Part II, Item 7 for additional discussion of these and other

risks facing our business.

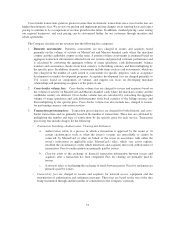

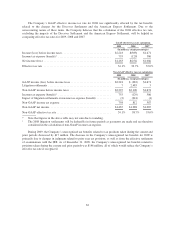

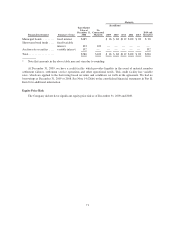

2009 2008 2007

Percent Increase (Decrease)

2009 2008

(In millions, except percentages)

Cash Flow Data:

Net cash provided by operating activities .............. $1,378 $ 413 $ 770 233.5% (46.3)%

Net cash provided by (used in) investing activities ....... (664) 202 315 (429.4)% (36.0)%

Net cash used in financing activities .................. (185) (751) (658) 75.4% (14.3)%

Balance Sheet Data:

Current assets .................................... $5,003 $4,312 $4,592 16.0% (6.1)%

Current liabilities ................................. 3,167 2,990 2,363 5.9 % 26.5%

Long-term liabilities ............................... 791 1,553 865 (49.1)% 79.5%

Equity .......................................... 3,512 1,932 3,032 81.8% (36.3)%

Cash Flow

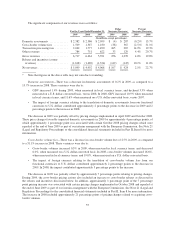

Net cash provided by operating activities for the year ended December 31, 2009 was $1.4 billion, compared

to $413 million and $770 million in 2008 and 2007, respectively. In 2009, cash from operations was primarily

due to operating income, collections of accounts receivable and income taxes receivable and increases in accrued

expenses for personnel and advertising costs, partially offset by approximately $946 million in litigation

settlement payments. In 2008, cash from operations resulted from an increase of $2.5 billion in litigation

settlement obligations, partially offset by $1.3 billion in payments for litigation settlements and increases in

accounts receivable and income taxes receivable. In 2007, cash from operations was primarily due to operating

income less the realized pre-tax gain on the sale of shares of common stock in RedeCard S.A. which is classified

as an investing activity.

Net cash used by investing activities in 2009 primarily related to expenditures for our global network and

net purchases of investment securities. Net cash provided by investing activities in 2008 primarily related to net

sales of investment securities, partially offset by expenditures for our payment card network and an acquisition of

a business. In 2007, cash provided by investing activities was primarily due to the net sales of investment

securities, including common shares of RedeCard S.A., partially offset by expenditures for our payment card

network. We intend to continue to invest in our infrastructure to support our growing business and strategic

initiatives.

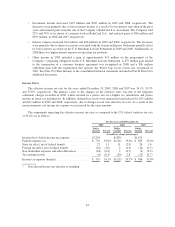

The auction rate securities (“ARS”) market was illiquid as of December 31, 2009 and 2008 and therefore

our ARS are classified as long-term available-for-sale securities. We had $212 million and $240 million of ARS,

at amortized cost, as of December 31, 2009 and 2008, respectively. Although the ARS market is illiquid, issuer

63