MasterCard 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Recent Accounting Pronouncements

Transfers of financial assets—In June 2009, the accounting standard for transfers and servicing of financial

assets and extinguishments of liabilities was amended. The change eliminates the qualifying special purpose

entity concept, establishes a new unit of account definition that must be met for the transfer of portions of

financial assets to be eligible for sale accounting, clarifies and changes the derecognition criteria for a transfer to

be accounted for as a sale, changes the amount of gain or loss on a transfer of financial assets accounted for as a

sale when beneficial interests are received by the transferor, and requires additional new disclosures. The

Company will adopt the new standard upon its effective date of January 1, 2010 and does not expect the impact

of the adoption to be material to the Company’s financial position or results of operations.

Variable interest entities—In June 2009, there was a revision to the accounting standard for the

consolidation of variable interest entities. The revision eliminates the exemption for qualifying special purpose

entities, requires a new qualitative approach for determining whether a reporting entity should consolidate a

variable interest entity, and changes the requirement of when to reassess whether a reporting entity should

consolidate a variable interest entity. During February 2010, the scope of the revised standard was modified to

indefinitely exclude certain entities from the requirement to be assessed for consolidation. The standard is

effective beginning on January 1, 2010 and the Company does not expect the impact of the adoption to be

material to the Company’s financial position or results of operations.

Revenue arrangements with multiple deliverables—In September 2009, the accounting standard for the

allocation of revenue in arrangements involving multiple deliverables was amended. Current accounting

standards require companies to allocate revenue based on the fair value of each deliverable, even though such

deliverables may not be sold separately either by the company itself or other vendors. The new accounting

standard eliminates (i) the residual method of revenue allocation and (ii) the requirement that all undelivered

elements must have objective and reliable evidence of fair value before a company can recognize the portion of

the overall arrangement fee that is attributable to items that already have been delivered. The Company will

adopt the revised accounting standard effective January 1, 2011 via prospective adoption. The Company is

currently evaluating the requirements of the standard to determine the impact on the Company’s financial

position or results of operations.

Improving fair value disclosures—In January 2010, fair value disclosure requirements were amended and

will require incremental disclosures about instruments within the valuation categories used in the fair value

measurements. The Company will adopt the guidance during 2010 and 2011, as required, and the adoption will

have no impact on the Company’s financial position or results of operations.

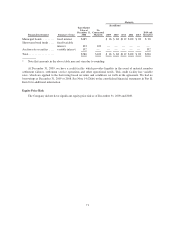

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market risk is the potential for economic losses to be incurred on market risk sensitive instruments arising

from adverse changes in market factors such as interest rates, foreign currency exchange rates and equity price

risk. We have limited exposure to market risk from changes in interest rates, foreign exchange rates and equity

price risk. Management establishes and oversees the implementation of policies, which have been approved by

the Board of Directors, governing our funding, investments and use of derivative financial instruments. We

monitor risk exposures on an ongoing basis. There were no material changes in our market risk exposures at

December 31, 2009 as compared to December 31, 2008.

Foreign Exchange Risk

We enter into forward exchange contracts to minimize risk associated with anticipated receipts and

disbursements which are either transacted in a non-functional currency or valued based on a currency other than

our functional currencies. We also enter into contracts to offset possible changes in value due to foreign

exchange fluctuations of assets and liabilities denominated in foreign currencies. The objective of this activity is

69