MasterCard 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

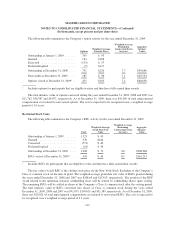

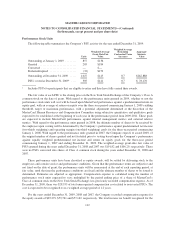

equity awards was $30,333, $20,726 and $19,828 for the years ended December 31, 2009, 2008 and 2007,

respectively. The income tax benefit related to options exercised during 2009 was $7,545. The additional paid-in

capital balance attributed to the equity awards was $197,350, $135,538 and $114,637 as of December 31, 2009,

2008 and 2007, respectively.

On July 18, 2006, the Company’s stockholders approved the MasterCard Incorporated 2006 Non-Employee

Director Equity Compensation Plan (the “Director Plan”). The Director Plan provides for awards of Deferred

Stock Units (“DSUs”) to each director of the Company who is not a current employee of the Company. There are

100 shares of Class A common stock reserved for DSU awards under the Director Plan. During the years ended

December 31, 2009, 2008 and 2007, the Company granted 7 DSUs, 4 DSUs and 8 DSUs, respectively. The fair

value of the DSUs was based on the closing stock price on the New York Stock Exchange of the Company’s

Class A common stock on the date of grant. The weighted average grant-date fair value of DSUs granted during

the years ended December 31, 2009, 2008 and 2007 was $168.18, $284.92 and $139.27, respectively. The DSUs

vested immediately upon grant and will be settled in shares of the Company’s Class A common stock on the

fourth anniversary of the date of grant. Accordingly, the Company recorded general and administrative expense

of $1,151, $1,209 and $1,051 for the DSUs for the years ended December 31, 2009, 2008 and 2007, respectively.

The total income tax benefit recognized in the income statement for DSUs was $410, $371 and $413 for the years

ended December 31, 2009, 2008 and 2007, respectively.

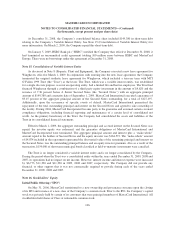

Note 18. Commitments

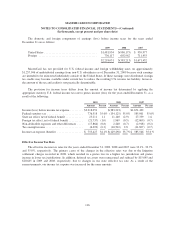

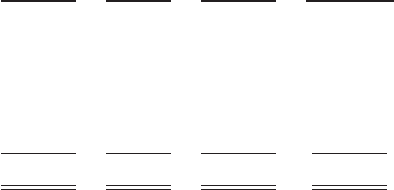

At December 31, 2009, the Company had the following future minimum payments due under

non-cancelable agreements:

Total

Capital

Leases

Operating

Leases

Sponsorship,

Licensing &

Other

2010 .................................... $283,987 $ 7,260 $ 25,978 $250,749

2011 .................................... 146,147 4,455 17,710 123,982

2012 .................................... 108,377 3,221 15,358 89,798

2013 .................................... 59,947 36,838 10,281 12,828

2014 .................................... 13,998 — 8,371 5,627

Thereafter ................................ 25,579 — 22,859 2,720

Total .................................... $638,035 $51,774 $100,557 $485,704

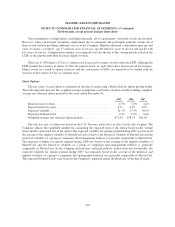

Included in the table above are capital leases with imputed interest expense of $7,929 and a net present

value of minimum lease payments of $43,845. In addition, at December 31, 2009, $63,616 of the future

minimum payments in the table above for leases, sponsorship, licensing and other agreements was accrued.

Consolidated rental expense for the Company’s office space, which is recognized on a straight line basis over the

life of the lease, was approximately $39,586, $42,905 and $35,614 for the years ended December 31, 2009, 2008

and 2007, respectively. Consolidated lease expense for automobiles, computer equipment and office equipment

was $9,137, $7,694 and $7,679 for the years ended December 31, 2009, 2008 and 2007, respectively.

In January 2003, MasterCard purchased a building in Kansas City, Missouri for approximately $23,572. The

building is a co-processing data center which replaced a back-up data center in Lake Success, New York. During

2003, MasterCard entered into agreements with the City of Kansas City for (i) the sale-leaseback of the building

and related equipment which totaled $36,382 and (ii) the purchase of municipal bonds for the same amount

113