MasterCard 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Accordingly, we do not issue cards, extend credit to cardholders, determine the interest rates (if applicable) or

other fees charged to cardholders by issuers, or establish the merchant discount charged by acquirers in

connection with the acceptance of cards that carry our brands.

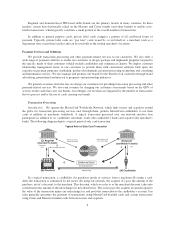

Our business has a global reach and has continued to experience growth. In 2009, we processed 22.4 billion

transactions, a 6.9% increase over the number of transactions processed in 2008. Gross dollar volume (“GDV”)

on cards carrying the MasterCard brand as reported by our customers was approximately $2.5 trillion in 2009, a

3.3% decrease in U.S. dollar terms and a 1.4% increase in local currency terms over the GDV reported in 2008.

We believe the trend within the global payments industry from paper-based forms of payment, such as cash

and checks, toward electronic forms of payment, such as payment card transactions, creates significant

opportunities for the growth of our business over the longer term. Our strategy is to continue to grow by further

penetrating our existing customer base and by expanding our role in targeted geographies and higher growth

segments of the global payments industry (such as premium/affluent, quick-service/low value, commercial/small

business, debit, prepaid and issuer and acquirer processor services), pursuing domestic processing opportunities

throughout the world, enhancing our merchant relationships, expanding points of acceptance for our brands,

seeking to maintain unsurpassed acceptance and continuing to invest in our brands. We also intend to pursue

incremental payment processing opportunities throughout the world. We are committed to providing our

customers with coordinated services through integrated and dedicated account teams in a manner that allows us

to capitalize on our expertise in payment programs, marketing, product development, technology, processing and

consulting and information services for these customers. By investing in strong customer relationships over the

long term, we believe that we can increase our volume of business with customers over time.

We operate in a dynamic and rapidly evolving legal and regulatory environment. In recent years, we have

faced heightened regulatory scrutiny and other legal challenges, particularly with respect to interchange fees.

Interchange fees, which represent a sharing of payment system costs among acquirers and issuers, have been the

subject of increased regulatory and legislative scrutiny, as well as litigation, as card-based forms of payment have

become relatively more important to local economies. Although we establish certain interchange rates and collect

and remit interchange fees on behalf of our customers, we do not earn revenues from interchange fees. However,

if issuers were unable to collect interchange fees or were to receive reduced interchange fees, we may experience

a reduction in the number of customers willing to participate in a four-party payment card system such as ours

and/or a reduction in the rate of number of cards issued, as well as lower overall transaction volumes. Proprietary

end-to-end networks or other forms of payment may also become more attractive. Issuers might also decide to

charge higher fees to cardholders, thereby making our card programs less desirable and reducing our transaction

volumes and profitability. They also might attempt to decrease the expense of their card programs by seeking a

reduction in the fees that we charge. In addition to those challenges relating to interchange fees, we are also

exposed to a variety of significant lawsuits and regulatory actions, including federal antitrust claims, and claims

under state unfair competition statutes. See “Risk Factors—Legal and Regulatory Risks” in Part I, Item 1A.

MasterCard Incorporated was incorporated as a Delaware stock corporation in May 2001. We conduct our

business principally through MasterCard Incorporated’s principal operating subsidiary, MasterCard International

Incorporated (“MasterCard International”), a Delaware non-stock (or membership) corporation that was formed

in November 1966. Our customers are generally either principal members of MasterCard International, which

participate directly in MasterCard International’s business, or affiliate members of MasterCard International,

which participate indirectly in MasterCard International’s business through a principal member. In May 2006, we

completed a plan for a new ownership and governance structure for MasterCard Incorporated (including an initial

public offering of a new class of common stock (the “IPO”)), which we refer to as the “ownership and

governance transactions” and which included the appointment of a new Board of Directors comprised of a

majority of directors who are independent from our customers. For more information about our capital structure,

voting rights of our common stock, repurchases of our Class A common stock and conversions of shares of our

Class B common stock into shares of our voting Class A common stock, see Note 16 (Stockholders’ Equity) to

the consolidated financial statements included in Part II, Item 8.

4