MasterCard 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

adoption had no impact on the Company’s financial position or results of operations; it required additional

financial statement disclosures. The Company has applied these disclosure requirements on a prospective basis.

Accordingly, disclosures related to periods prior to the date of adoption have not been presented.

The Company does not designate foreign currency forward contracts as hedging instruments pursuant to the

accounting standards for derivative instruments and hedging activities. The Company records the change in the

estimated fair value of the outstanding forward contracts at the end of the reporting period to its consolidated

balance sheet and consolidated statement of operations.

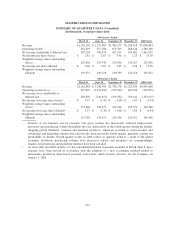

As of December 31, 2009, all contracts to purchase and sell foreign currency had been entered into with

customers of MasterCard International. MasterCard’s forward contracts are classified by functional currency as

summarized below:

U.S. Dollar Functional Currency

December 31, 2009 December 31, 2008

Notional

Estimated

Fair Value1Notional

Estimated

Fair Value1

Commitments to purchase foreign currency .................. $37,998 $ (463)1$292,538 $21,9131

Commitments to sell foreign currency ...................... 50,296 (776)1154,187 12,2271

Balance Sheet Location:

Accounts Receivable ................................ $ 628 $34,227

Other Current Liabilities ............................. (1,867) (87)

Euro Functional Currency

December 31, 2009 December 31, 2008

Notional

Estimated

Fair Value1Notional

Estimated

Fair Value1

Commitments to purchase foreign currency ................... $16,122 $ (72)1$— $—

Commitments to sell foreign currency ....................... 45,038 $ 37166,405 (409)1

Balance Sheet Location:

Accounts Receivable ................................. 81 $ 290

Other Current Liabilities .............................. (116) (699)

Amount and Location of Gain (Loss)

Recognized in Income during the Year Ended

December 31, 2009

Derivatives Not Designated As Hedging Instruments

Foreign Currency Forward Contracts .......................... General and administrative $(11,944)

Revenues (6,087)

Total $(18,031)

1Amounts represent gross fair value amounts while these amounts may be netted for actual balance sheet

presentation.

131