MasterCard 2009 Annual Report Download - page 137

Download and view the complete annual report

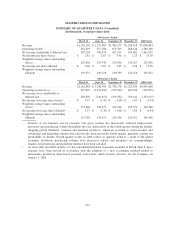

Please find page 137 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

2009, the HCA issued to MasterCard a Preliminary Position that MasterCard Europe’s historic domestic

interchange fees violate Hungarian competition law. MasterCard responded to the Preliminary Position both in

writing and at a hearing which was held on September 8 and 9, 2009. On September 24, 2009, the HCA ruled

that MasterCard’s (and Visa’s) historic interchange fees violated the law and fined MasterCard Europe and Visa

Europe each approximately $2,600, which was paid during the fourth quarter of 2009. The HCA issued its formal

decision on December 2, 2009 and on December 18, 2009, MasterCard appealed the decision to the Hungarian

courts. If the HCA’s decision is not reversed on appeal, it could have a significant adverse impact on the

revenues of MasterCard’s Hungarian customers and on MasterCard’s overall business in Hungary.

Italy. On July 15, 2009, the Italian Competition Authority (ICA) commenced a proceeding against

MasterCard and a number of its customers concerning MasterCard Europe’s domestic interchange fees in Italy.

MasterCard, as well as each of the banks involved in the proceeding, offered to give certain undertakings to the

ICA, which were rejected. If the Italian Competition Authority issues a Statement of Objections to MasterCard in

connection with the matter, MasterCard would have the opportunity to respond both in writing and at a hearing

and, if a negative decision were reached, to appeal the decision. A negative decision could result in MasterCard

and/or its customers being fined and, if not reversed on appeal, could have a significant adverse impact on the

revenues of MasterCard’s Italian customers and on MasterCard’s overall business in Italy.

New Zealand. In November 2003, MasterCard assumed responsibility for setting domestic default

interchange fees in New Zealand, which previously had been set by MasterCard’s customer financial institutions

in New Zealand. In early 2004, the New Zealand Competition Commission (the “NZCC”) commenced an

investigation of MasterCard’s domestic interchange fees. MasterCard cooperated with the NZCC in its

investigation, made a number of submissions concerning its New Zealand domestic default interchange fees and

met with the NZCC on several occasions to discuss its investigation. In November 2006, the NZCC filed a

lawsuit alleging that MasterCard’s (and Visa’s) domestic default interchange fees and certain other of

MasterCard’s practices, including its “honor all cards” rule, do not comply with New Zealand competition law,

and seeking penalties. Several large merchants subsequently filed similar lawsuits seeking damages and

injunctive relief. On August 24, 2009, MasterCard entered into a settlement with the NZCC under which, in

return for the NZCC terminating the proceeding as against MasterCard, MasterCard agreed to modify and/or

clarify some of its rules as they apply to New Zealand. These rule modifications, which were instituted as a result

of the settlement, include the fact that MasterCard will set maximum interchange rates for New Zealand

transactions and post them on its website, and issuers will be permitted to set their own interchange fees up to the

maximum rates, and MasterCard will not prohibit merchants from imposing a surcharge on their customers when

they choose to use their MasterCard cards to make purchases in New Zealand, so long as merchants inform

customers and any surcharges bear a reasonable relationship to the merchant’s cost of accepting MasterCard

cards. In agreeing to the settlement with the NZCC, MasterCard did not admit any wrongdoing or pay any

penalties (however, MasterCard did agree to pay half of the NZCC’s legal costs). On October 2, 2009,

MasterCard entered into a settlement with the merchant plaintiffs under which, in return for the merchant

plaintiffs terminating the proceeding as against MasterCard, MasterCard agreed, among other things and subject

to certain conditions, to give the merchants the same commitments as it had given the NZCC, as set forth above.

In agreeing to the settlement with the merchant plaintiffs, MasterCard did not admit any wrongdoing or agree to

pay any damages (however, MasterCard did agree to pay half of the merchant plaintiffs’ legal costs).

Australia. In 2002, the Reserve Bank of Australia (“RBA”) announced regulations under the Payments

Systems (Regulation) Act of 1998 applicable to four-party credit card payment systems in Australia, including

MasterCard’s. Those regulations, among other things, mandate the use of a formula for determining domestic

interchange fees that effectively caps their weighted average at 50 basis points. Operators of three-party systems,

such as American Express and Diners Club, were unaffected by the interchange fee regulation. In 2007, the RBA

127