MasterCard 2009 Annual Report Download - page 59

Download and view the complete annual report

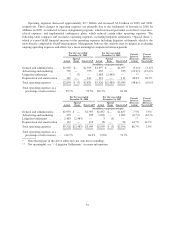

Please find page 59 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.environment. General and administrative expenses decreased 3.1% in 2009 due to lower expenses for

professional fees and travel, partially offset by increased personnel expenses as a result of severance costs

incurred related to the realignment of our resources. Advertising and marketing expenses declined 19.2% in 2009

due to reduced spending on sponsorship and promotional activities reflecting cost management initiatives and

market realities.

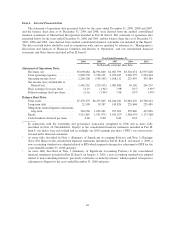

Our ratios of operating income (loss) as a percentage of net revenues, or operating margins, were 44.3% in

2009 versus (10.7%) in 2008 and 27.2% in 2007. Excluding the impact of special items, our operating margins

were 44.5% in 2009, versus 39.0% in 2008 and 27.3% in 2007.

Other income (expense) varies depending on activities not core to our operations. In 2009, we did not have

significant activity comparable to gains realized in 2008 and 2007.

We believe the trend within the global payments industry from paper-based forms of payment, such as cash

and checks, toward electronic forms of payment, such as payment card transactions, creates significant

opportunities for the growth of our business over the longer term. See “—Business Environment” for a

discussion of environmental considerations related to our long-term strategic objectives.

Business Environment

We process transactions from more than 210 countries and territories and in more than 150 currencies.

Revenue generated in the United States was approximately 45.5%, 47.2% and 49.7% of total revenues in 2009,

2008 and 2007, respectively. No individual country, other than the United States, generated more than 10% of

total revenues in any period, but differences in market maturity, economic health, price changes and foreign

exchange fluctuations in certain countries have increased the proportion of revenues generated outside the United

States over time. While the global nature of our business helps protect our operating results from adverse

economic conditions in a single or a few countries, the significant concentration of our revenues generated in the

United States makes our business particularly susceptible to adverse economic conditions in the United States.

The competitive and evolving nature of the global payments industry provides both challenges to and

opportunities for the continued growth of our business. Unprecedented events which began during 2008

continued to impact the financial markets around the world, including continued distress in the credit

environment, continued equity market volatility and additional government intervention. In particular, the

economies of the United States and the United Kingdom have continued to be significantly impacted by this

economic turmoil, and it is also impacting other economies around the world. Some existing customers have

been placed in receivership or administration or have a significant amount of their stock owned by their

governments. Many financial institutions are facing increased regulatory and governmental influence, including

potential changes in laws and regulations. Many of our financial institution customers, merchants that accept our

brands and cardholders who use our brands have been directly and adversely impacted.

MasterCard’s financial results may be negatively impacted by actions taken by individual financial

institutions or by governmental or regulatory bodies in response to the economic crisis. The severity of the

economic environment may accelerate the timing of or increase the impact of risks to our financial performance

that have historically been present. As a result, our revenue growth has been and may be negatively impacted, or

the Company may be impacted, in several ways, including but not limited to the following:

• Declining economies, foreign currency fluctuations and the pace of economic recovery can change

consumer spending behaviors; for example, a significant portion of our revenues is dependent on cross-

border travel patterns, which may continue to change.

• Constriction of consumer and business confidence such as in recessionary environments and those

markets experiencing rising unemployment may continue to cause decreased spending by cardholders.

49