MasterCard 2009 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

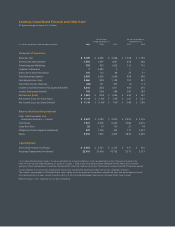

Summary Consolidated Financial and Other Data*

All fi gures throughout report in U.S. dollars

(1) As more fully described in Note 1 (Summary of Significant Accounting Policies) to the consolidated financial statements included in the

Form 10-K for the year ended December 31, 2009, on January 1, 2009, a new accounting standard related to the EPS effects of instruments

granted in share-based payment transactions became effective for the Company resulting in the retrospective adjustment of EPS for prior periods.

(2) Data represents all transactions processed by MasterCard, including PIN-based online debit transactions, regardless of brand.

The numbers were updated in 2009 to exclude a small number of certain processed transactions initiated with cards that do not bear our brands.

All prior period data has been revised to be consistent with this revised methodology. Revenue was not impacted by these changes.

*Note that figures in this table may not sum due to rounding.

For the Years For the Three Months

Ended December 31 Ended March 31

(In millions except per-share and operating data) 2009 2008 2007 2010 2009

Statement of Operations

Revenues, Net $ 5,099 $ 4,992 $ 4,068 $ 1,308 $ 1,156

General and Administrative 1,935 1,997 1,857 458 448

Advertising and Marketing 755 935 1,002 115 116

Litigation Settlements 7 2,483 3 — —

Depreciation and Amortization 141 112 98 35 31

Total Operating Expenses 2,839 5,526 2,959 608 595

Operating Income (Loss) 2,260 (535) 1,108 700 561

Total Other Income (Expense) (42) 151 563 (5) (11)

Income (Loss) before Income Tax Expense (Benefi t) 2,218 (383) 1,671 695 550

Income Tax Expense (Benefi t) 755 (129) 586 240 183

Net Income (Loss) $ 1,463 $ (254) $ 1,086 $ 455 $ 367

Net Income (Loss) per Share (Basic) $ 11.19 $ (1.94)1 $ 7.981 $ 3.47 $ 2.81

Net Income (Loss) per Share (Diluted) $ 11.16 $ (1.94)1 $ 7.961 $ 3.46 $ 2.80

Balance Sheet Data (at period end)

Cash, Cash Equivalents and

Investment Securities — Current $ 2,879 $ 2,093 $ 2,970 $ 2,950 $ 2,276

Total Assets 7,470 6,476 6,260 7,286 6,415

Long-Term Debt 22 19 150 21 18

Obligations Under Litigation Settlements 870 1,736 404 731 1,610

Equity 3,512 1,932 3,032 3,832 2,229

Operating Data

Gross Dollar Volume (in billions) $ 2,454 $ 2,537 $ 2,273 $ 631 $ 550

Processed Transactions (in millions)

2 22,410 20,954 18,752 5,373 5,137