MasterCard 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

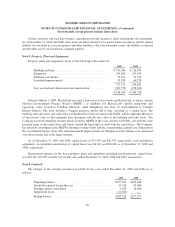

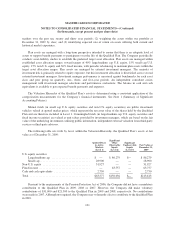

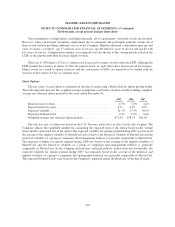

markets over the past ten, twenty and thirty year periods; (2) weighting the assets within our portfolio at

December 31, 2009 by class; and (3) identifying expected rate of return on assets utilizing both current and

historical market experience.

Plan assets are managed with a long-term perspective intended to ensure that there is an adequate level of

assets to support benefit payments to participants over the life of the Qualified Plan. The Company periodically

conducts asset-liability studies to establish the preferred target asset allocation. Plan assets are managed within

established asset allocation ranges, toward targets of 40% large/medium cap U.S. equity, 15% small cap U.S.

equity, 15% non-U.S. equity and 30% fixed income, with periodic rebalancing to maintain plan assets within the

target asset allocation ranges. Plan assets are managed by external investment managers. The majority of

investment risk is primarily related to equity exposure, but this investment allocation is diversified across several

external investment managers. Investment manager performance is measured against benchmarks for each asset

class and peer group on quarterly, one-, three- and five-year periods. An independent consultant assists

management with investment manager selections and performance evaluations. The balance in cash and cash

equivalents is available to pay expected benefit payments and expenses.

The Valuation Hierarchy of the Qualified Plan’s assets is determined using a consistent application of the

categorization measurements for the Company’s financial instruments. See Note 1 (Summary of Significant

Accounting Policies).

Mutual funds (in small cap U.S. equity securities and non-U.S. equity securities) are public investment

vehicles valued at quoted market prices, which represent the net asset value of the shares held by the Qualified

Plan and are therefore included in Level 1. Commingled funds (in large/medium cap U.S. equity securities and

fixed income securities) are valued at unit values provided by investment managers, which are based on the fair

value of the underlying investments utilizing public information, independent external valuation from third-party

services or third-party advisors.

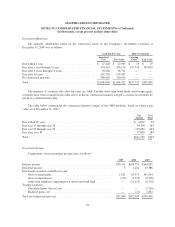

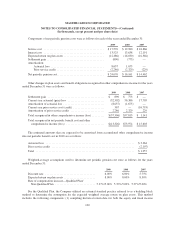

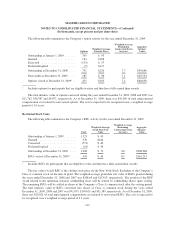

The following table sets forth by level, within the Valuation Hierarchy, the Qualified Plan’s assets at fair

value as of December 31, 2009:

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair Value at

December 31,

2009

U.S. equity securities

Large/medium cap ........................... $ — $ 86,279 $— $ 86,279

Small cap ................................... 28,900 — — 28,900

Non-U.S. equity ................................. 31,927 — — 31,927

Fixed income .................................... — 63,757 — 63,757

Cash and cash equivalents ......................... 2,750 — — 2,750

Total .......................................... $63,577 $150,036 $— $213,613

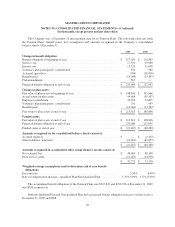

Pursuant to the requirements of the Pension Protection Act of 2006, the Company did not have a mandatory

contribution to the Qualified Plan in 2009, 2008 or 2007. However, the Company did make voluntary

contributions of $31,000 and $21,500 to the Qualified Plan in 2009 and 2008, respectively. No contributions

were made in 2007. Although not required, the Company may voluntarily elect to contribute to the Qualified Plan

in 2010.

101