MasterCard 2009 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

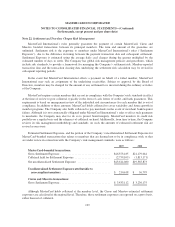

appeal were filed. With regard to other state court currency conversion actions, MasterCard has reached

agreements in principle with the plaintiffs for a total of $3,557, which has been accrued. Settlement agreements

have been executed with plaintiffs in the Ohio, Pennsylvania, Florida, Texas, Arkansas, Tennessee, Arizona,

New York, Minnesota, Illinois and Missouri actions. At this time, it is not possible to predict with certainty the

ultimate resolution of these matters.

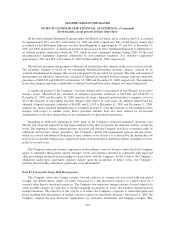

U.S. Merchant and Consumer Litigations

Commencing in October 1996, several class action suits were brought by a number of U.S. merchants

against MasterCard International and Visa U.S.A., Inc. challenging certain aspects of the payment card industry

under U.S. federal antitrust law. Those suits were later consolidated in the U.S. District Court for the Eastern

District of New York. The plaintiffs claimed that MasterCard’s “Honor All Cards” rule (and a similar Visa rule),

which required merchants who accept MasterCard cards to accept for payment every validly presented

MasterCard card, constituted an illegal tying arrangement in violation of Section 1 of the Sherman Act. Plaintiffs

claimed that MasterCard and Visa unlawfully tied acceptance of debit cards to acceptance of credit cards. On

June 4, 2003, MasterCard International signed a settlement agreement to settle the claims brought by the

plaintiffs in this matter, which the Court approved on December 19, 2003. On January 24, 2005, the Second

Circuit Court of Appeals issued an order affirming the District Court’s approval of the settlement agreement thus

making it final. On July 1, 2009, MasterCard International entered into an agreement with the plaintiffs to prepay

MasterCard International’s remaining payment obligations under the settlement agreement at a discount. On

August 26, 2009, the court entered a final order approving the prepayment agreement. The agreement became

final pursuant to its terms on September 25, 2009 as there were no appeals of the court’s approval, and the

prepayment was made on September 30, 2009. See Note 19 (Obligations under Litigation Settlements) for

additional discussion.

In addition, individual or multiple complaints have been brought in 19 different states and the District of

Columbia alleging state unfair competition, consumer protection and common law claims against MasterCard

International (and Visa) on behalf of putative classes of consumers. The claims in these actions largely mirror the

allegations made in the U.S. merchant lawsuit and assert that merchants, faced with excessive merchant discount

fees, have passed these overcharges to consumers in the form of higher prices on goods and services sold.

MasterCard has been successful in dismissing cases in seventeen of the jurisdictions as courts have granted

MasterCard’s motions to dismiss for failure to state a claim or plaintiffs have voluntarily dismissed their

complaints. However, there are outstanding cases in New Mexico and California. The parties are awaiting a

decision on MasterCard’s motion to dismiss in New Mexico. In December 2008, MasterCard reached an

agreement in principle to resolve the California state court actions described above for a payment by MasterCard

of $6,000. As discussed above under “Department of Justice Antitrust Litigation and Related Party Litigations,”

in connection with the Attridge action, on September 14, 2009, the parties to the California state court actions

executed a settlement agreement which the parties believe would resolve the actions, subject to approval by the

California state court. On January 5, 2010, the court executed an order preliminarily approving the settlement. A

hearing on final approval of the settlement is set for July 16, 2010.

At this time, it is not possible to determine the outcome of, or, except as indicated above in the California

consumer action, estimate the liability related to, the remaining consumer cases and no provision for losses has

been provided in connection with them. The consumer class actions are not covered by the terms of the

settlement agreement in the U.S. merchant lawsuit.

121