MasterCard 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

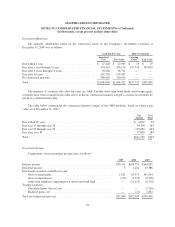

required to be included in computing EPS under the two-class method. The Company declared non-forfeitable

dividends on unvested restricted stock units and contingently issuable performance stock units (“Unvested

Units”) which were granted prior to 2009. The Company has therefore calculated EPS under the two-class

method pursuant to this new accounting standard.

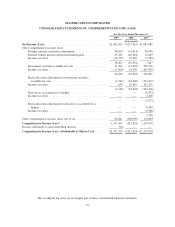

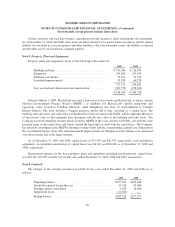

The components of basic and diluted EPS for common shares under the two-class method for each of the

years ended December 31:

2009 2008 2007

Numerator:

Net income (loss) attributable to MasterCard ........ $1,462,532 $(253,915) $1,085,886

Less: Net income (loss) allocated to Unvested

Units ..................................... 9,083 (1,304) 9,892

Net income (loss) attributable to MasterCard allocated

to common shares ........................... $1,453,449 $(252,611) $1,075,994

Denominator:

Basic EPS weighted average shares outstanding ..... 129,838 130,148 134,887

Dilutive stock options and restricted stock units ..... 394 — 266

Diluted EPS weighted-average shares outstanding . . . 130,232 130,148 135,153

Earnings (Loss) per Share:

Basic ....................................... $ 11.19 $ (1.94) $ 7.98

Diluted ...................................... $ 11.16 $ (1.94) $ 7.96

The calculation of diluted earnings per share for the year ended December 31, 2009 excluded approximately

251 stock options because the effect would be antidilutive. The calculation of diluted loss per share for the year

ended December 31, 2008 excluded approximately 705 stock options because the effect would be antidilutive.

The calculation of diluted earnings per share for the year ended December 31, 2007 excluded approximately 10

stock options because the effect would be antidilutive.

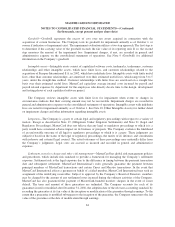

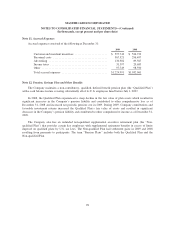

The following table compares EPS as originally reported and EPS under the two-class method, to quantify

the impact of the new standard on EPS for each of the years ended December 31:

2008 2007

Earnings (Loss) per Share:

Basic—as originally reported ....................................... $(1.95) $ 8.05

Basic—pursuant to the two-class method ............................. (1.94) 7.98

Impact of new accounting standard on basic EPS ....................... $0.01 $(0.07)

Diluted—as originally reported ..................................... $(1.95) $ 8.00

Diluted—pursuant to the two-class method ............................ (1.94) 7.96

Impact of new accounting standard on diluted EPS ...................... $0.01 $(0.04)

88