MasterCard 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Statement Caption/

Critical Accounting Estimate Assumptions/Approach Used

Effect if Actual Results Differ

from Assumptions

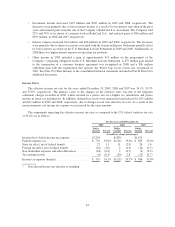

Asset Impairment Analyses

Prepaid Customer and Merchant

Incentives

We prepay certain customer and

merchant business incentives. In the

event of customer or merchant

business failure, these incentives

may not have future economic

benefits for our business.

Impairment analysis is performed

quarterly or whenever events or

changes in circumstances indicate

that their carrying amount may not

be recoverable. The impairment

analysis for each customer requires

an estimation of our customer’s

future performance and an

assessment of the agreement terms

to determine the future net cash

flows expected from the customer

agreement.

Our estimates of customer

performance are based on

historical customer performance,

discussions with our customer and

our expectations for the future.

If events or changes in

circumstances occur that we are not

aware of, additional impairment

charges related to our prepaid

customer and merchant incentives

may be incurred. The carrying value

of prepaid customer and merchant

incentives was $445 million at

December 31, 2009.

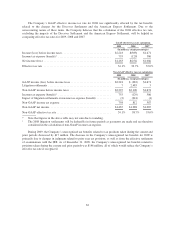

Goodwill and Intangible Assets

(excluding Capitalized Software)

We perform analyses of goodwill

and intangible assets on an annual

basis or sooner if indicators of

impairment exist.

Goodwill and intangible assets are

assigned to our reporting units. The

fair value of each reporting unit is

compared to the carrying value of

the respective reporting unit. Our

goodwill policies are fully described

in Note 1 (Summary of Significant

Accounting Policies) to the

consolidated financial statements in

Part II, Item 8 of this report.

We utilized a weighted income

and market approach for

determining the fair values of our

reporting units. Our significant

valuation judgments included

forecasting cash flows, selection

of discount rates and selection of

comparable companies. We used

both internal and external data to

make these judgments.

If market conditions or business

conditions change in the future, we

may be exposed to impairment

charges associated with goodwill and/

or intangible assets. The net carrying

value of goodwill and intangible

assets, excluding capitalized software,

was $539 million, including $209

million of unamortizable customer

relationships, as of December 31,

2009.

We determined that the majority of

our customer relationships, which

are intangible assets, have indefinite

lives. In addition to the impairment

testing noted above, we assess the

appropriateness of that indefinite

life annually.

We used internal data regarding

changes in our customer

relationships and future cash flows

to assess the indefinite life and

assess fair value.

If a definite life is deemed to be

more appropriate, it would require

amortization of the customer

relationships which would result in

a decline of future net income.

68