MasterCard 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

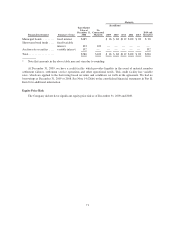

Critical Accounting Estimates

Our accounting policies are integral to understanding our results of operations and financial condition. We

are required to make estimates and assumptions that affect the reported amounts of assets and liabilities, and

disclosure of contingent assets and liabilities, at the date of the financial statements, and the reported amounts of

revenue and expenses during the reporting periods. We have established detailed policies and control procedures

to ensure that the methods used to make estimates and assumptions are well controlled and are applied

consistently from period to period. The following is a brief description of our current accounting policies

involving significant management judgments.

Financial Statement Caption/

Critical Accounting Estimate Assumptions/Approach Used

Effect if Actual Results Differ

from Assumptions

Revenue Recognition

Our domestic assessments require

an estimate of our customers’

quarterly GDV or GEV to realize

quarterly domestic assessments each

quarter.

Our domestic assessments included

an estimate representing 13% of

total domestic assessments in each

of 2009, 2008 and 2007 and 6%, 6%

and 7% of total net revenues in

2009, 2008 and 2007, respectively.

Our revenue recognition policies are

fully described in Note 1 (Summary

of Significant Accounting Policies)

to the consolidated financial

statements in Part II, Item 8 of this

Report.

Our customers’ GDV and GEV is

estimated by using historical

performance, transactional

information accumulated from our

systems and discussions with our

customers.

Such estimates are subsequently

validated against the GDV or

GEV reported by our customers.

Differences are adjusted in the

period the customer reports.

If our customers’ actual

performance is not consistent with

our estimates of their performance,

realized revenues may be materially

different than initially estimated.

Historically, our estimates have

differed from the actual

performance by less than 5% of the

estimates on a quarterly basis.

Rebates and incentives are generally

recorded as contra-revenue based on

our estimate of each customer’s

performance in a given period and

according to the terms of the related

customer agreements. Examples of

the customer performance items

requiring estimation include GDV or

GEV, transactions, issuance of new

cards, launch of new programs or the

execution of marketing programs.

In addition, certain customer

agreements include prepayment of

rebates and incentives. Amortization

of prepayments and other assets

may be on straight-line basis over

the life of the agreement or based on

customer performance depending on

the terms of the related customer

agreements.

Our estimates of each customer’s

performance are based on

historical customer performance,

transactional information

accumulated from our systems and

discussions with our customers.

Such estimates are subsequently

validated by information reported

by our customers. Differences are

adjusted in the period the

customer reports.

If our customers’ actual

performance is not consistent with

our estimates of their performance,

contra-revenues may be materially

different than initially estimated.

66