MasterCard 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

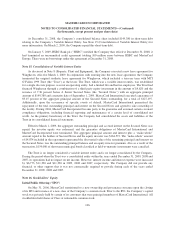

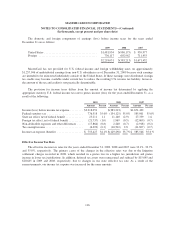

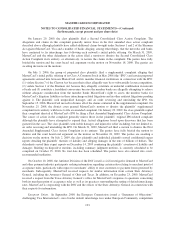

The domestic and foreign components of earnings (loss) before income taxes for the years ended

December 31 are as follows:

2009 2008 2007

United States ..................................... $1,481,934 $(986,175) $ 959,977

Foreign ......................................... 736,117 602,962 711,455

$2,218,051 $(383,213) $1,671,432

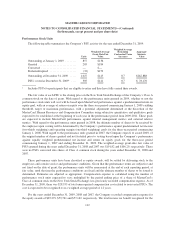

MasterCard has not provided for U.S. federal income and foreign withholding taxes on approximately

$1,257,946 of undistributed earnings from non-U.S. subsidiaries as of December 31, 2009 because such earnings

are intended to be reinvested indefinitely outside of the United States. If these earnings were distributed, foreign

tax credits may become available under current law to reduce the resulting U.S. income tax liability, however,

the amount of the tax and credits is not practically determinable.

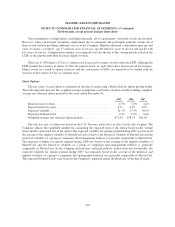

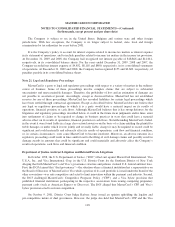

The provision for income taxes differs from the amount of income tax determined by applying the

appropriate statutory U.S. federal income tax rate to pretax income (loss) for the years ended December 31, as a

result of the following:

2009 2008 2007

Amount Percent Amount Percent Amount Percent

Income (loss) before income tax expense ......... $2,218,051 $(383,213) $1,671,432

Federal statutory tax ......................... 776,318 35.0% (134,125) 35.0% 585,001 35.0%

State tax effect, net of federal benefit ............ 25,211 1.1 11,140 (2.9) 27,359 1.6

Foreign tax effect, net of federal benefit .......... (21,737) (1.0) 1,969 (0.5) (12,069) (0.7)

Non-deductible expenses and other differences .... (17,866) (0.8) 2,260 (0.7) (2,918) (0.2)

Tax exempt income .......................... (6,499) (0.3) (10,542) 2.8 (11,827) (0.7)

Income tax expense (benefit) .................. $ 755,427 34.1% $(129,298) 33.7% $ 585,546 35.0 %

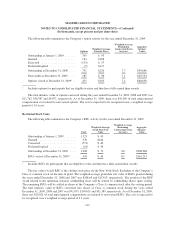

Effective Income Tax Rate

The effective income tax rates for the years ended December 31, 2009, 2008 and 2007 were 34.1%, 33.7%

and 35.0%, respectively. The primary cause of the changes in the effective rates was due to the litigation

settlement charges recorded in 2008, which resulted in a pretax loss in a higher tax jurisdiction and pretax

income in lower tax jurisdictions. In addition, deferred tax assets were remeasured and reduced by $15,045 and

$20,605 in 2009 and 2008, respectively, due to changes in our state effective tax rate. As a result of the

remeasurements, our income tax expense was increased for the same amounts.

116