MasterCard 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

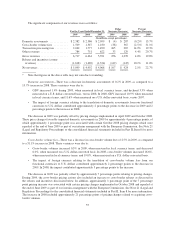

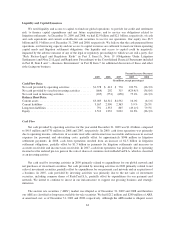

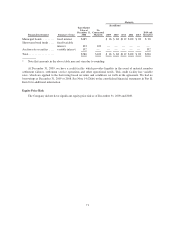

Future Obligations

The following table summarizes our obligations as of December 31, 2009 that are expected to impact

liquidity and cash flow in future periods. We believe we will be able to fund these obligations through cash

generated from operations and our existing balances of cash and cash equivalents.

Payments Due by Period

Total 2010 2011-2012 2013-2014

2015 and

thereafter

(In millions)

Capital leases1....................................... $ 52 $ 7 $ 8 $ 37 $—

Operating leases2..................................... 101 26 33 19 23

Sponsorship, licensing and other3,4 ....................... 496 261 214 18 3

Litigation settlements5................................ 910 606 304 — —

Debt6.............................................. 21 — 21 — —

Total .............................................. $1,580 $900 $580 $ 74 $ 26

* Note that totals in above table may not sum due to rounding.

1Mostly related to certain property, plant and equipment. Capital lease for global technology and operations

center located in O’Fallon, Missouri has been excluded from this table; see Note 8 (Property, Plant and

Equipment) to the consolidated financial statements included in Part II, Item 8 for further discussion. There

is a capital lease for the Kansas City, Missouri co-processing data center.

2We enter into operating leases in the normal course of business. Substantially all lease agreements have

fixed payment terms based on the passage of time. Some lease agreements provide us with the option to

renew the lease or purchase the leased property. Our future operating lease obligations would change if we

exercised these renewal options and if we entered into additional lease agreements.

3Amounts primarily relate to sponsorships with certain organizations to promote the MasterCard brand. The

amounts included are fixed and non-cancelable. In addition, these amounts include amounts due in

accordance with merchant agreements for future marketing, computer hardware maintenance, software

licenses and other service agreements. Future cash payments that will become due to our customers under

agreements which provide pricing rebates on our standard fees and other incentives in exchange for

transaction volumes are not included in the table because the amounts due are indeterminable and

contingent until such time as performance has occurred. MasterCard has accrued $598 million as of

December 31, 2009 related to customer and merchant agreements.

4Includes current liability of $10 million relating to the accounting for uncertainty in income taxes. Due to

the high degree of uncertainty regarding the timing of the non-current liabilities for uncertainties in income

taxes, we are unable to make reasonable estimates of the period of cash settlements with the respective

taxing authority.

5Represents amounts due in accordance with the American Express Settlement and other litigation settlements.

The American Express Settlement requires six remaining quarterly payments of $150 million each.

6Debt primarily represents amounts due for the acquisition of MasterCard France. We also have various

credit facilities for which there were no outstanding balances at December 31, 2009 that, among other

things, would provide liquidity in the event of settlement failures by our members. Our debt obligations

would change if one or more of our members failed and we borrowed under these credit facilities to settle on

our members’ behalf or for other reasons.

Seasonality

The changes in the global economic environment during 2009 and 2008 impacted our historical trends

experienced during the fourth quarter each year, which have included increased revenues and expenses related to

end of the year activities. Our revenues depend heavily upon the overall level of consumer, business and

government spending. Our lower revenue growth rates began in the fourth quarter 2008 and continued during

2009 and are primarily due to lower growth rates in purchase volumes and transactions than in the past. In

addition, MasterCard implemented resource realignment and cost savings initiatives, with particular focus on

personnel, travel expenditures and advertising, during 2009 and 2008. As our business and the economic

environment continue to evolve, we expect new trends to emerge.

65