MasterCard 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our Industry

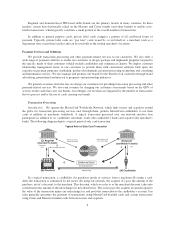

We operate in the global payments industry, which consists of all forms of payment including:

• Paper—cash, personal checks, money orders, official checks, travelers checks and other paper-based

means of transferring value;

• Cards—credit cards, charge cards, debit cards (including Automated Teller Machine (“ATM”) cards),

pre-paid cards and other types of cards; and

• Emerging and Other Forms of Payment—wire transfers, electronic benefits transfers, bill payments,

Automated Clearing House payments and payments using mobile devices, among others.

The most common card-based forms of payment are general purpose cards, which are payment cards

carrying logos that permit widespread usage of the cards within countries, regions or around the world. General

purpose cards have different attributes depending on the type of accounts to which they are linked:

• “pay later” cards, such as credit or charge cards, typically access a credit account that either requires

payment of the full balance within a specified period (a charge card) or that permits the cardholder to

carry a balance in a revolving credit account (a credit card);

• “pay now” cards, such as debit cards, typically access a demand deposit or current account maintained

by the cardholder; and

• “pay before” cards, such as prepaid or electronic purse cards, typically access a pool of value previously

funded.

Generally, card-based forms of payment involve two types of transactions (depending on the type of card

being used): transactions that typically require the cardholder’s signature, which are referred to as offline

transactions; and transactions that require the cardholder to use a personal identification number (“PIN”) for

verification, which are typically referred to as online transactions. Some purchase transactions outside of the

United States, such as those made using cards equipped with a chip, can be PIN-authenticated but are considered

offline transactions. In addition, some payment cards are equipped with an RFID (radio frequency identification)

microchip, which provides an advanced authentication technique, and technology which allows contactless

payments requiring neither signature nor PIN. Many merchants no longer require a signature for low value

purchases, and there is no PIN or signature on Internet or other card-not-present transactions. Such transactions

are still considered, however, to be offline transactions.

The primary general purpose card brands include MasterCard, Visa®, American Express®, JCB®, Diners

Club®and Discover®. Historically, these brands—including MasterCard—were principally associated with “pay

later” (credit or charge) cards in the United States and other major markets around the world. Today, MasterCard

(as well as Visa and others) may issue cards in the “pay now” and “pay before” categories as well.

“Pay Now” cards may be further categorized into several sub-segments:

• Signature-based debit cards are cards for which the primary means of cardholder validation at the point

of sale is for the cardholder to sign a sales receipt (other than circumstances where an actual signature is

not necessary). MasterCard and Visa-branded cards constitute the majority of signature-based debit

cards.

• PIN-based debit cards are cards with which cardholders generally enter a PIN at a point-of-sale terminal

for validation. PIN-based debit card brands include our Maestro brand and Visa’s brands. The

MasterCard brand also functions as a PIN-based debit brand in the United States.

• Cash access cards are cards which permit cardholders to obtain cash principally at ATMs by entering a

PIN. The primary global cash access card brands are our Cirrus brand and Visa’s Plus®brand.

5