MasterCard 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

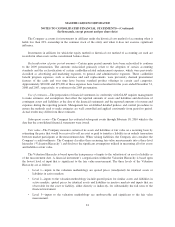

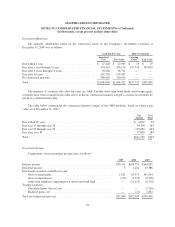

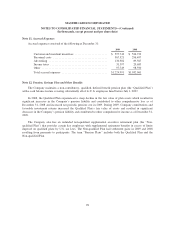

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair Value at

December 31,

2008

Municipal bonds1................................ $ — $485,490 $ — $485,490

Taxable short-term bond funds ...................... 102,588 — — 102,588

Auction rate securities ............................ — — 191,760 191,760

Foreign currency forward contracts .................. — 33,731 — 33,731

Other .......................................... 17 — — 17

Total .......................................... $102,605 $519,221 $191,760 $813,586

1Available-for-sale municipal bonds are carried at fair value and are included in the above tables. However,

held-to-maturity municipal bonds are carried at amortized cost and excluded from the above tables.

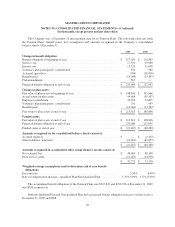

The fair value of the Company’s available-for-sale municipal bonds are based on quoted prices for similar

assets in active markets and are therefore included in Level 2 of the Valuation Hierarchy.

The fair value of the Company’s short-term bond funds are based on quoted prices and are therefore

included in Level 1 of the Valuation Hierarchy.

The Company’s auction rate securities (“ARS”) investments have been classified within Level 3 of the

Valuation Hierarchy as their valuation requires substantial judgment and estimation of factors that are not

currently observable in the market due to the lack of trading in the securities. This valuation may be revised in

future periods as market conditions evolve. The Company has considered the lack of liquidity in the ARS market

and the lack of comparable, orderly transactions when estimating the fair value of its ARS portfolio. Therefore,

the Company uses the income approach, which includes a discounted cash flow analysis of the estimated future

cash flows adjusted by a risk premium, to estimate the fair value of its ARS portfolio. When a determination is

made to classify a financial instrument within Level 3, the determination is based upon the significance of the

unobservable parameters to the overall fair value measurement. However, the fair value determination for Level

3 financial instruments may include observable components.

The Company’s foreign currency forward contracts have been classified within Level 2 of the valuation

hierarchy, as the fair value is based on broker quotes for the same or similar derivative instruments. See Note 23

(Foreign Exchange Risk Management) for further details.

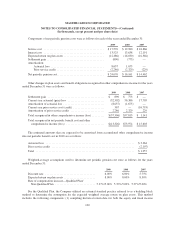

Financial Instruments—Non-Recurring Measurements

Certain financial instruments are carried on the consolidated balance sheets at cost, which approximates fair

value due to their short-term, highly liquid nature. These instruments include cash and cash equivalents, accounts

receivable, settlement due from customers, restricted security deposits held for customers, prepaid expenses,

accounts payable, settlement due to customers and accrued expenses.

Investment Securities Held-to-Maturity

The Company utilizes quoted prices for identical and similar securities from active markets to estimate the

fair value of its held-to-maturity securities. See Note 5 (Investment Securities) for fair value disclosure.

90