MasterCard 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

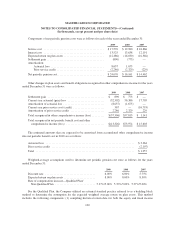

Certain customer and merchant business agreements provide incentives upon entering into the agreement.

As of December 31, 2009 and 2008, other assets included amounts to be paid for these incentives and the related

liability was included in accrued expenses and other liabilities. Once the payment is made, the liability is relieved

and the other asset is reclassified to a prepaid expense.

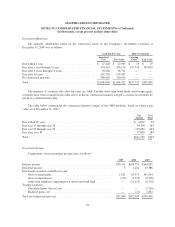

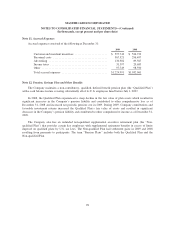

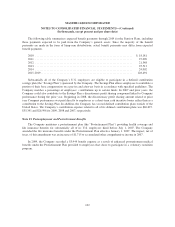

Note 8. Property, Plant and Equipment

Property, plant and equipment consist of the following at December 31:

2009 2008

Building and land ...................................... $391,946 $ 216,670

Equipment ............................................ 254,830 250,395

Furniture and fixtures ................................... 52,101 51,124

Leasehold improvements ................................ 53,876 66,878

752,753 585,067

Less accumulated depreciation and amortization .............. (303,759) (278,269)

$ 448,994 $ 306,798

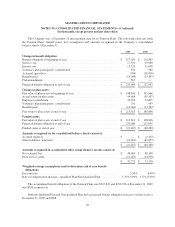

Effective March 1, 2009, MasterCard executed a new ten-year lease between MasterCard, as tenant, and the

Missouri Development Finance Board (“MDFB”), as landlord, for MasterCard’s global technology and

operations center located in O’Fallon, Missouri, called Winghaven (see Note 15 (Consolidation of Variable

Interest Entity)). The lease includes a bargain purchase option and is thus classified as a capital lease. The

building and land assets and capital lease obligation have been recorded at $154,000, which represents the lesser

of the present value of the minimum lease payments and the fair value of the building and land assets. The

Company received refunding revenue bonds issued by MDFB in the exact amount, $154,000, and with the same

payment terms as the capital lease and which contain the legal right of setoff with the capital lease. The Company

has netted its investment in the MDFB refunding revenue bonds and the corresponding capital lease obligation in

the consolidated balance sheet. The related leasehold improvements for Winghaven will continue to be amortized

over the economic life of the improvements.

As of December 31, 2009 and 2008, capital leases of $13,565 and $46,794, respectively, were included in

equipment. Accumulated amortization of capital leases was $6,181 and $36,180 as of December 31, 2009 and

2008, respectively.

Depreciation expense for the above property, plant and equipment, including amortization for capital leases

was $76,121, $59,097 and $49,311 for the years ended December 31, 2009, 2008 and 2007, respectively.

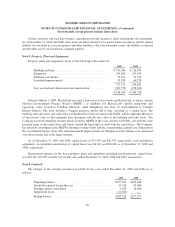

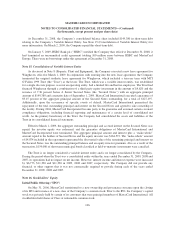

Note 9. Goodwill

The changes in the carrying amount of goodwill for the years ended December 31, 2009 and 2008 are as

follows:

2009 2008

Beginning balance ....................................... $297,993 $239,626

Goodwill acquired during the year .......................... 13,518 67,066

Foreign currency translation ............................... 9,020 (8,699)

Impairment losses ....................................... (11,303) —

Ending balance ......................................... $309,228 $297,993

96