MasterCard 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

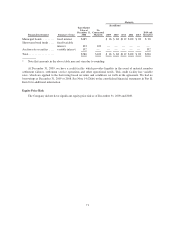

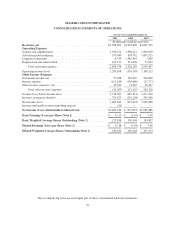

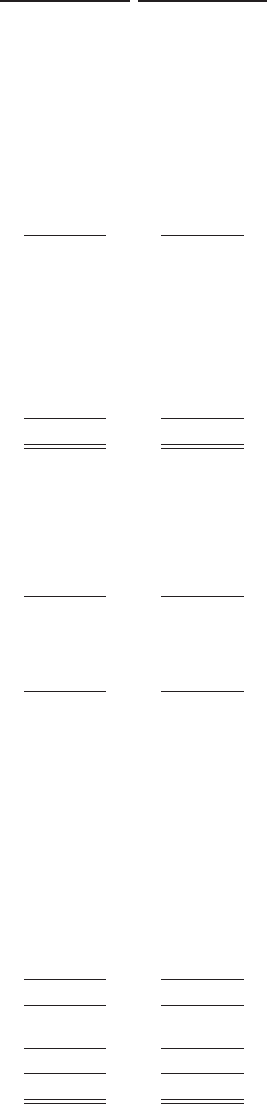

MASTERCARD INCORPORATED

CONSOLIDATED BALANCE SHEETS

December 31, 2009 December 31, 2008

(In thousands, except share data)

ASSETS

Cash and cash equivalents ..................................................... $2,055,439 $ 1,505,160

Investment securities, at fair value:

Available-for-sale ........................................................ 824,345 588,095

Municipal bonds held-to-maturity ............................................... — 154,000

Accounts receivable .......................................................... 536,472 639,482

Income taxes receivable ....................................................... — 198,308

Settlement due from customers .................................................. 459,173 513,191

Restricted security deposits held for customers ..................................... 445,989 183,245

Prepaid expenses ............................................................. 313,253 213,612

Deferred income taxes ........................................................ 243,561 283,795

Other current assets ........................................................... 124,915 32,619

Total Current Assets ..................................................... 5,003,147 4,311,507

Property, plant and equipment, at cost (less accumulated depreciation of $303,759 and

$278,269) ................................................................ 448,994 306,798

Deferred income taxes ........................................................ 264,237 567,567

Goodwill ................................................................... 309,228 297,993

Other intangible assets (less accumulated amortization of $422,338 and $377,570) ......... 414,704 394,282

Auction rate securities available-for-sale, at fair value ................................ 179,987 191,760

Investment securities held-to-maturity ............................................ 337,797 37,450

Prepaid expenses ............................................................. 327,884 302,095

Other assets ................................................................. 184,301 66,397

Total Assets ............................................................ $7,470,279 $ 6,475,849

LIABILITIES AND EQUITY

Accounts payable ............................................................ $ 290,414 $ 253,276

Settlement due to customers .................................................... 477,576 541,303

Restricted security deposits held for customers ..................................... 445,989 183,245

Obligations under litigation settlements (Note 19) ................................... 606,485 713,035

Accrued expenses ............................................................ 1,224,991 1,032,061

Short-term debt .............................................................. — 149,380

Other current liabilities ........................................................ 121,676 118,151

Total Current Liabilities ................................................. 3,167,131 2,990,451

Deferred income taxes ........................................................ 79,728 74,518

Obligations under litigation settlements (Note 19) ................................... 263,236 1,023,263

Long-term debt .............................................................. 21,598 19,387

Other liabilities .............................................................. 426,719 436,255

Total Liabilities ......................................................... 3,958,412 4,543,874

Commitments (Notes 18, 19 and 21)

Stockholders’ Equity

Class A common stock, $.0001 par value; authorized 3,000,000,000 shares, 116,534,029 and

105,126,588 shares issued and 109,793,439 and 98,385,998 outstanding, respectively .... 11 10

Class B common stock, $.0001 par value; authorized 1,200,000,000 shares, 19,977,657 and

30,848,778 shares issued and outstanding, respectively ............................. 3 4

Class M common stock, $.0001 par value; authorized 1,000,000 shares, 1,812 and 1,728

shares issued and outstanding, respectively ...................................... — —

Additional paid-in-capital ...................................................... 3,412,354 3,304,604

Class A treasury stock, at cost, 6,740,590 shares, respectively ......................... (1,250,000) (1,250,000)

Retained earnings (accumulated deficit) ........................................... 1,147,714 (236,100)

Accumulated other comprehensive income:

Cumulative foreign currency translation adjustments ............................ 211,860 175,040

Defined benefit pension and other postretirement plans, net of tax .................. (14,740) (43,207)

Investment securities available-for-sale, net of tax ............................... (3,442) (22,996)

Total accumulated other comprehensive income .................................... 193,678 108,837

Total Stockholders’ Equity ............................................... 3,503,760 1,927,355

Non-controlling interests ...................................................... 8,107 4,620

Total Equity ................................................................ 3,511,867 1,931,975

Total Liabilities and Equity ................................................... $7,470,279 $ 6,475,849

The accompanying notes are an integral part of these consolidated financial statements.

75