MasterCard 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

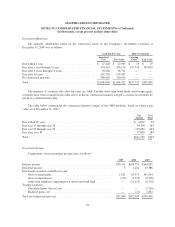

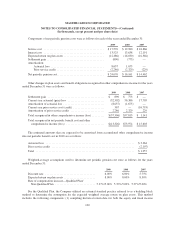

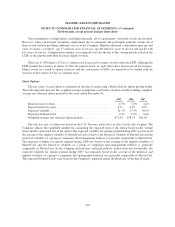

Components of net periodic pension costs were as follows for each of the years ended December 31:

2009 2008 2007

Service cost .......................................... $17,570 $ 19,980 $ 18,866

Interest cost .......................................... 13,525 13,638 12,191

Expected return on plan assets ............................ (12,486) (16,030) (16,366)

Settlement gain ........................................ (890) (773) —

Amortization:

Actuarial loss ..................................... 8,637 1,675 —

Prior service credit ................................. (2,286) (2,329) (229)

Net periodic pension cost ................................ $24,070 $ 16,161 $ 14,462

Other changes in plan assets and benefit obligations recognized in other comprehensive income for the years

ended December 31 were as follows:

2009 2008 2007

Settlement gain ........................................ $ 890 $ 773 $ —

Current year actuarial (gain) loss .......................... (32,302) 56,386 17,705

Amortization of actuarial loss ............................. (8,637) (1,675) —

Current year prior service cost (credit) ...................... 367 — (16,793)

Amortization of prior service credit ........................ 2,286 2,329 229

Total recognized in other comprehensive income (loss) ......... $(37,396) $57,813 $ 1,141

Total recognized in net periodic benefit cost and other

comprehensive income (loss) ........................... $(13,326) $73,974 $ 15,603

The estimated amounts that are expected to be amortized from accumulated other comprehensive income

into net periodic benefit cost in 2010 are as follows:

Actuarial loss .............................................................. $3,364

Prior service credit .......................................................... (2,107)

Total ..................................................................... $1,257

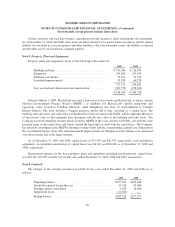

Weighted-average assumptions used to determine net periodic pension cost were as follows for the years

ended December 31:

2009 2008 2007

Discount rate ................................... 6.00% 6.00% 5.75%

Expected return on plan assets ...................... 8.00% 8.00% 8.50%

Rate of compensation increase—Qualified Plan/

Non-Qualified Plan ............................ 5.37%/5.00% 5.37%/5.00% 5.37%/5.00%

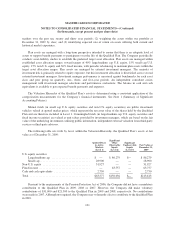

For the Qualified Plan, the Company utilized an actuarial standard practice referred to as a building block

method to determine the assumption for the expected weighted average return on plan assets. This method

includes the following components: (1) compiling historical return data for both the equity and fixed income

100