MasterCard 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

The Company does not make any contributions to its Postretirement Plan other than funding benefits payments.

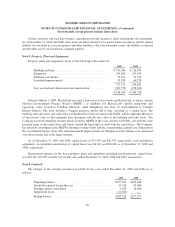

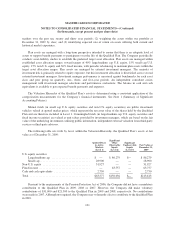

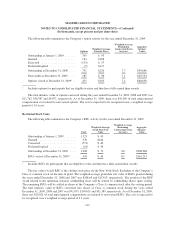

The following table summarizes expected net benefit payments from the Company’s general assets through 2019:

Benefit

Payments

Expected

Subsidy

Receipts

Net

Benefit

Payments

2010 .................................................. $ 2,714 $ 71 $ 2,643

2011 .................................................. 3,028 91 2,937

2012 .................................................. 3,369 111 3,258

2013 .................................................. 3,660 134 3,526

2014 .................................................. 4,019 151 3,868

2015 – 2019 ............................................ 22,686 1,071 21,615

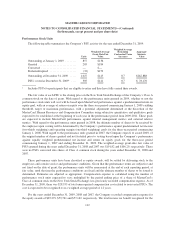

The Company provides limited postemployment benefits to eligible former U.S. employees, primarily

severance under a formal severance plan (the “Severance Plan”). The Company accounts for severance expense by

accruing the expected cost of the severance benefits expected to be provided to former employees after employment

over their relevant service periods. The Company updates the assumptions in determining the severance accrual by

evaluating the actual severance activity and long-term trends underlying the assumptions. As a result of updating the

assumptions, the Company recorded incremental severance expense (benefit) related to the Severance Plan of

$3,471, $2,643 and $(3,418), respectively, during the years 2009, 2008 and 2007. These amounts were part of total

severance expenses of $135,113, $32,997 and $21,284 in 2009, 2008 and 2007, respectively, included in general

and administrative expenses in the accompanying consolidated statements of operations.

Note 14. Debt

On April 28, 2008, the Company extended its committed unsecured revolving credit facility, dated as of

April 28, 2006 (the “Credit Facility”), for an additional year. The new expiration date of the Credit Facility is

April 26, 2011. The available funding under the Credit Facility will remain at $2,500,000 through April 27, 2010

and then decrease to $2,000,000 during the final year of the Credit Facility agreement. Other terms and

conditions in the Credit Facility remain unchanged. The Company’s option to request that each lender under the

Credit Facility extend its commitment was provided pursuant to the original terms of the Credit Facility

agreement. Borrowings under the facility are available to provide liquidity in the event of one or more settlement

failures by MasterCard International customers and, subject to a limit of $500,000, for general corporate

purposes. The facility fee and borrowing cost are contingent upon the Company’s credit rating. At December 31,

2009, the facility fee was 7 basis points on the total commitment, or approximately $1,774 annually. Interest on

borrowings under the Credit Facility would be charged at the London Interbank Offered Rate (LIBOR) plus an

applicable margin of 28 basis points or an alternative base rate, and a utilization fee of 10 basis points would be

charged if outstanding borrowings under the facility exceed 50% of commitments. At the inception of the Credit

Facility, the Company also agreed to pay upfront fees of $1,250 and administrative fees of $325, which are being

amortized over five years. Facility and other fees associated with the Credit Facility totaled $2,222, $2,353 and

$2,477 for each of the years ended December 31, 2009, 2008 and 2007, respectively. MasterCard was in

compliance with the covenants of the Credit Facility and had no borrowings under the Credit Facility at

December 31, 2009 or December 31, 2008. The majority of Credit Facility lenders are members or affiliates of

members of MasterCard International.

In June 1998, MasterCard International issued ten-year unsecured, subordinated notes (the “Notes”) paying

a fixed interest rate of 6.67% per annum. MasterCard repaid the entire principal amount of $80,000 on June 30,

2008 pursuant to the terms of the Notes. The interest expense on the Notes was $2,668 and $5,336 for each of the

years ended December 31, 2008 and 2007, respectively.

105