MasterCard 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.which brings together merchants, acquirers, issuers and processors twice a year to examine payments innovation

at the point of interaction, and to seek to enhance the experience for merchants and consumers at the point of sale

or in an online shopping environment for a retail sales transaction. We also continue to develop our acquirer and

merchant sales teams around the world. Moreover, we have recently introduced a suite of information products,

data analytics and marketing services which can help merchants understand specific activity in their industry,

evaluate their sales performance against competitors and focus direct marketing efforts to target desirable

prospects and hard to reach segments.

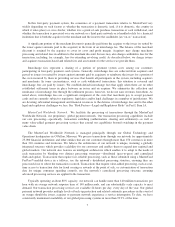

MasterCard Revenue Sources

MasterCard processes transactions denominated in more than 150 currencies through our global system,

providing cardholders with the ability to utilize, and merchants to accept, MasterCard cards across multiple

country borders. For example, we may process a transaction in a merchant’s local currency; however the charge

for the transaction would appear on the cardholder’s statement in the cardholder’s home currency. We process

most of the cross-border transactions using MasterCard, Maestro and Cirrus-branded cards and process the

majority of MasterCard-branded domestic transactions in the United States, United Kingdom, Canada, Brazil and

Australia.

MasterCard generates revenues by charging fees to our customers for providing transaction processing and

other payment-related services and assessing our customers based on the dollar volume of activity on the cards

that carry our brands. Our net revenues are classified into the following five categories:

•Domestic assessments: Domestic assessments are fees charged to issuers and acquirers based

primarily on the volume of activity on MasterCard and Maestro-branded cards where the merchant

country and the cardholder country are the same. A portion of these assessments is estimated based on

aggregate transaction information collected from our systems and projected customer performance and

are calculated by converting the aggregate volume of usage (purchases, cash disbursements, balance

transfers and convenience checks) from local currency to the billing currency and then multiplying by

the specific price. In addition, domestic assessments include items such as card assessments, which are

fees charged on the number of cards issued or assessments for specific purposes, such as acceptance

development or market development programs. Acceptance development fees are charged primarily to

U.S. issuers based on components of volume, and support our focus on developing merchant

relationships and promoting acceptance at the point of sale.

•Cross-border volume fees: Cross-border volume fees are charged to issuers and acquirers based on the

volume of activity on MasterCard and Maestro-branded cards where the merchant country and

cardholder country are different. Cross-border volume fees are calculated by converting the aggregate

volume of usage (purchases and cash disbursements) from local currency to the billing currency and

then multiplying by the specific price. Cross-border volume fees also include fees, charged to issuers,

for performing currency conversion services.

•Transaction processing fees: Transaction processing fees are charged for both domestic and cross-

border transactions and are primarily based on the number of transactions. These fees are calculated by

multiplying the number and type of transactions by the specific price for each service. Transaction

processing fees include charges for transaction switching (authorization, clearing and settlement) and

connectivity.

•Other revenues: Other revenues for other payment-related services are primarily dependent on the

nature of the products or services provided to our customers but are also impacted by other factors, such

as contractual agreements. Examples of other revenues are fees associated with fraud products and

services, cardholder service fees, consulting and research fees, compliance and penalty fees, account and

transaction enhancement services, holograms and publications.

16