MasterCard 2009 Annual Report Download - page 138

Download and view the complete annual report

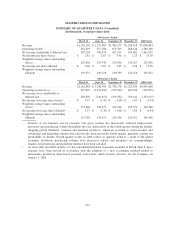

Please find page 138 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except percent and per share data)

commenced a review of such regulations and, on September 26, 2008, the RBA released its final conclusions. These

indicated that the RBA was willing to withdraw its regulations if MasterCard and Visa made certain undertakings

regarding the future levels of their respective credit card interchange fees and other practices, including their “honor

all cards” rules. If the undertakings were not made, the RBA said it would consider imposing in 2009 additional

regulations that could further reduce the domestic interchange fees of MasterCard and Visa in Australia. On

August 26, 2009, the RBA announced that it had decided not to withdraw its regulations and that it would maintain

them in their current form pending further consideration of the regulations. MasterCard plans to continue

discussions with the RBA as to the nature of the undertakings that MasterCard may be willing to provide. The effect

of the undertakings or any such additional regulations could put MasterCard at an even greater competitive

disadvantage relative to competitors in Australia that purportedly do not operate four-party systems or, in the case of

the undertakings, possibly increase MasterCard’s legal exposure under Australian competition laws, which could

have a significant adverse impact on MasterCard’s business in Australia.

South Africa. On August 4, 2006, the South Africa Competition Commission created a special body, the

Jali Enquiry (the “Enquiry”), to examine competition in the payments industry in South Africa, including

interchange fees. After nearly two years of investigation, including several rounds of public hearings in which

MasterCard participated, on June 25, 2008, the Enquiry published an Executive Summary of its findings. The

Enquiry’s full report was made public on December 12, 2008. The Enquiry recommends, among other things,

that an independent authority be established to set payment card interchange fees in South Africa and that

payment systems’ (including MasterCard’s) respective “honor all cards” rules be modified to give merchants

greater freedom to choose which types of cards to accept. The Enquiry’s report is non-binding but is under active

consideration by South African regulators. If adopted, the Enquiry’s recommendations could have a significant

adverse impact on MasterCard’s business in South Africa.

On October 21, 2008, the South African National Assembly (the “National Assembly”) adopted amendments

to that country’s competition laws concerning so-called “complex monopolies” and criminalizing certain violations

of those laws (the “South Africa Bill”). On January 29, 2009, the then President of South Africa referred the South

Africa Bill back to the National Assembly for further consideration and, in early February 2009, the National

Assembly readopted the South Africa Bill. The President also stated that he might submit the South Africa Bill to

that country’s Constitutional Court for review. In April 2009, South Africa elected a new President, who signed the

South Africa Bill on August 27, 2009 without either referring it to the Constitutional Court or setting a date on

which the South Africa Bill will enter into force. If and when the South Africa Bill becomes effective, it could have

a significant adverse impact on MasterCard’s business in South Africa.

Other Jurisdictions. In January 2006, a German retailers association filed a complaint with the Federal

Cartel Office (“FCO”) in Germany concerning MasterCard’s (and Visa’s) domestic default interchange fees. The

complaint alleges that MasterCard’s (and Visa’s) German domestic interchange fees are not transparent to

merchants and include so-called “extraneous costs”. On December 21, 2009, the FCO sent MasterCard a

questionnaire concerning its domestic interchange fees.

In July 2009, the Canadian Competition Bureau informed MasterCard that it intends to review MasterCard’s

(and Visa’s) interchange fees and related rules, such as the “honor all cards” and “no surcharge” rules.

MasterCard is aware that regulatory authorities and/or central banks in certain other jurisdictions including

Belgium, Brazil, Colombia, Czech Republic, Estonia, France, Israel, Mexico, the Netherlands, Norway,

Switzerland, Turkey and Venezuela are reviewing MasterCard’s and/or its members’ interchange fees and/or

related practices (such as the “honor all cards” rule) and may seek to regulate the establishment of such fees and/

or such practices.

128