MasterCard 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to reduce our exposure to transaction gains and losses resulting from fluctuations of foreign currencies against

our functional currencies, principally the U.S. dollar and euro. The terms of the forward currency contracts are

generally less than 18 months.

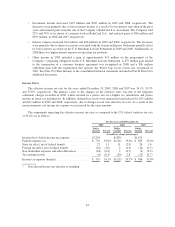

U.S. Dollar Functional Currency

(In millions) December 31, 2009 December 31, 2008

Notional

Estimated

Fair Value Notional

Estimated

Fair Value

Commitments to purchase foreign currency ..................... $38 $— $293 $22

Commitments to sell foreign currency .......................... 50 (1) 154 12

Euro Functional Currency

(In millions) December 31, 2009 December 31, 2008

Notional

Estimated

Fair Value Notional

Estimated

Fair Value

Commitments to purchase foreign currency ..................... $16 $— $— $—

Commitments to sell foreign currency .......................... 45 — 66 —

Our settlement activities are subject to foreign exchange risk resulting from foreign exchange rate

fluctuations. This risk is limited to the typical one business day timeframe between setting the foreign exchange

rates and clearing the financial transactions and by confining the supported settlement currencies to the U.S.

dollar or one of 16 other transaction currencies. The remaining 136 transaction currencies are settled in one of the

supported settlement currencies or require local settlement netting arrangements that minimize our foreign

exchange exposure.

Interest Rate Risk

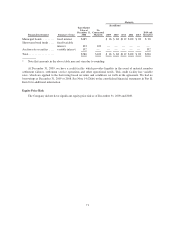

Our interest rate sensitive assets are our debt instruments, which we hold as available-for-sale investments.

With respect to fixed maturities, our general policy is to invest in high quality securities, while providing

adequate liquidity and maintaining diversification to avoid significant exposure. The fair value and maturity

distribution of the Company’s available for sale investments as of December 31 was as follows:

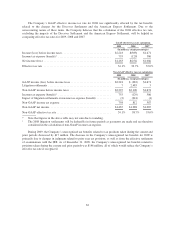

Maturity

(In millions)

Financial Instrument Summary Terms

Fair Market

Value at

December 31,

2009

No

Contractual

Maturity 2010 2011 2012 2013 2014

2015 and

thereafter

Municipal bonds ........ fixed interest $ 514 $— $ 28 $ 97 $ 96 $120 $ 80 $ 93

Short-term bond funds .... fixed/variable

interest 310 310 ————— —

Auction rate securities .... variable interest 180 — ————— 180

Total .................. $1,004 $310 $ 28 $ 97 $ 96 $120 $ 80 $273

70