Delta Airlines 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

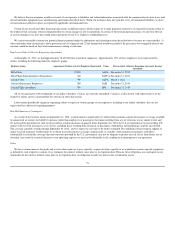

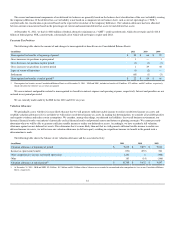

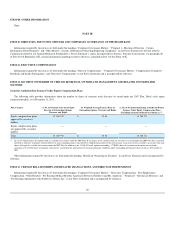

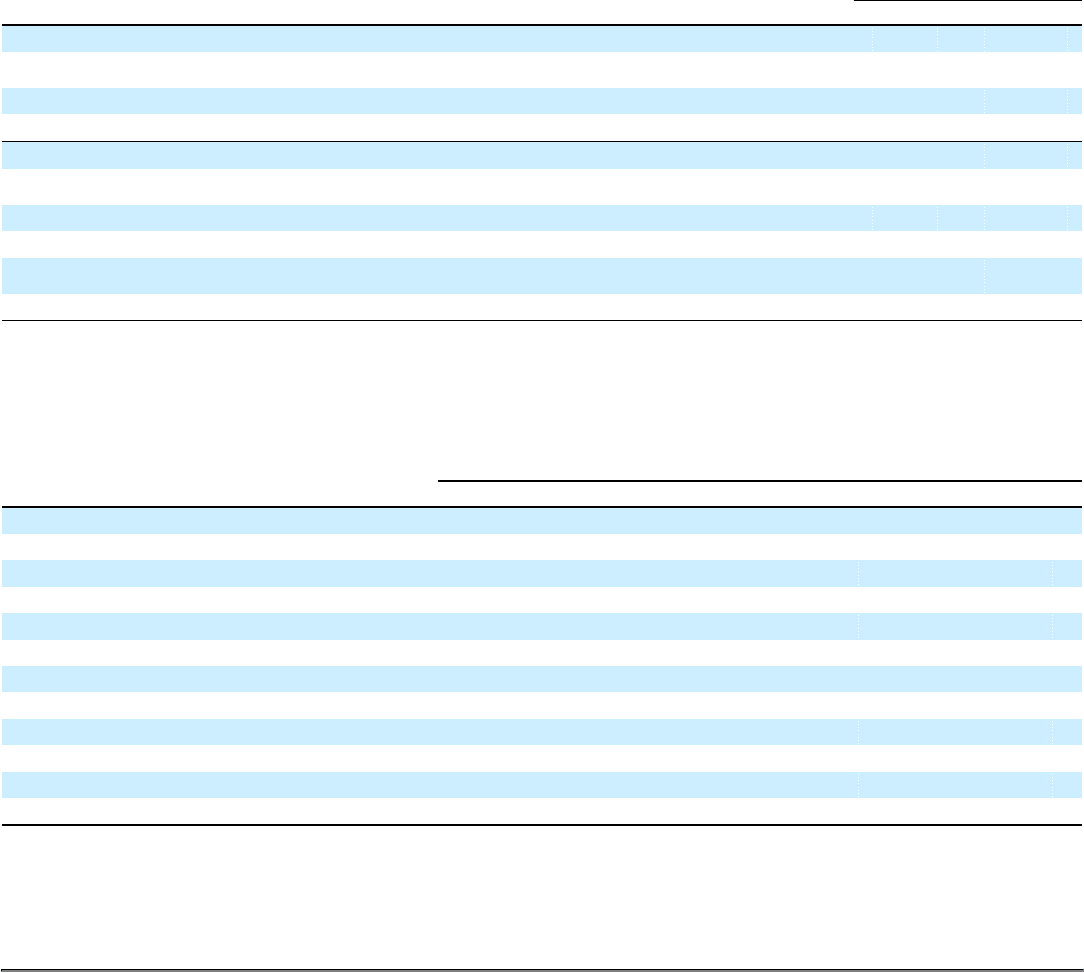

NOTE 16. EARNINGS (LOSS) PER SHARE

We calculate basic earnings (loss) per share by dividing the net income (loss) by the weighted average number of common shares outstanding. Shares

issuable upon the satisfaction of certain conditions are considered outstanding and included in the computation of basic earnings (loss) per share. Accordingly,

the calculation of basic earnings (loss) per share for the years ended December 31, 2011, 2010 and 2009 assumes there was outstanding at the beginning of

each of these periods all 386 million shares of Delta common stock contemplated by Delta's Plan of Reorganization to be distributed to holders of allowed

general, unsecured claims and nine million shares of Delta common stock reserved for issuance in exchange for shares of Northwest common stock that, but

for our merger with Northwest Airlines in 2008, would have been issued under Northwest's Plan of Reorganization. Similarly, the calculation of basic loss per

share for the year ended December 31, 2009 assumes there was outstanding at January 1, 2009, 50 million shares of Delta common stock we agreed to issue

on behalf of pilots in connection with the merger.

The following table shows our computation of basic and diluted earnings (loss) per share:

Year Ended December 31,

(in millions, except per share data) 2011 2010 2009

Net income (loss) $ 854 $ 593 $ (1,237)

Basic weighted average shares outstanding 838 834 827

Dilutive effects of share based awards 6 9 —

Diluted weighted average shares outstanding 844 843 827

Basic earnings (loss) per share $ 1.02 $ 0.71 $ (1.50)

Diluted earnings (loss) per share $ 1.01 $ 0.70 $ (1.50)

Antidilutive common stock equivalents excluded from diluted earnings (loss) per share 17 22 35

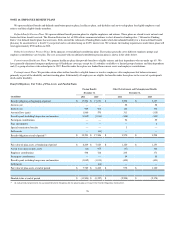

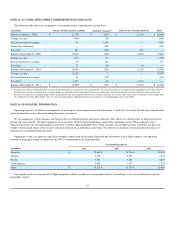

NOTE 17. QUARTERLY FINANCIAL DATA (UNAUDITED)

The following table summarizes our unaudited results of operations on a quarterly basis. The quarterly earnings (loss) per share amounts for a year will

not add to the earnings (loss) per share for that year due to the weighting of shares used in calculating per share data.

Three Months Ended

(in millions, except per share data) March 31 June 30(1) September 30(2)(3) December 31(2)

2011

Operating revenue $ 7,747 $ 9,153 $ 9,816 $ 8,399

Operating income (loss) (92) 481 860 726

Net income (loss) (318) 198 549 425

Basic earnings (loss) per share (0.38) 0.24 0.66 0.51

Diluted earnings (loss) per share (0.38) 0.23 0.65 0.50

2010

Operating revenue $ 6,848 $ 8,168 $ 8,950 $ 7,789

Operating income 68 852 1,003 294

Net income (loss) (256) 467 363 19

Basic earnings (loss) per share (0.31) 0.56 0.43 0.02

Diluted earnings (loss) per share (0.31) 0.55 0.43 0.02

(1) During the June 2011 quarter, we recorded $144 million of charges related to severance and related costs and our facilities consolidation and fleet assessments.

(2) During the September 2011 quarter, we recorded $208 million of fuel hedge losses for mark-to-market adjustments recorded in periods other than the settlement period and in the

December 2011 quarter, we recorded $164 million of fuel hedge gains for mark-to-market adjustments recorded in periods other than the settlement period.

(3) During the September 2010 quarter, we recorded (1) a $360 million loss associated with the primarily non-cash loss on extinguishment of debt, including the write-off of unamortized debt

discount and (2) a $146 million charge related to the Comair fleet reduction initiative.

85