Delta Airlines 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144

|

|

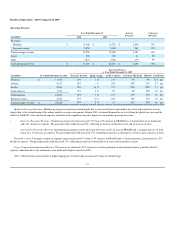

Part II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF

EQUITY SECURITIES

Market Information

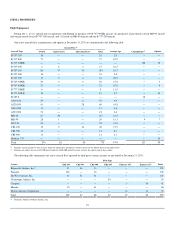

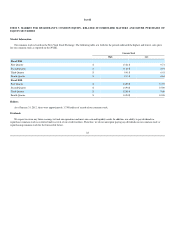

Our common stock is listed on the New York Stock Exchange. The following table sets forth for the periods indicated the highest and lowest sales price

for our common stock as reported on the NYSE.

Common Stock

High Low

Fiscal 2011

First Quarter $ 13.21 $ 9.71

Second Quarter $ 11.60 $ 8.91

Third Quarter $ 9.41 $ 6.41

Fourth Quarter $ 9.13 $ 6.64

Fiscal 2010

First Quarter $ 14.90 $ 10.93

Second Quarter $ 14.94 $ 10.90

Third Quarter $ 12.80 $ 9.60

Fourth Quarter $ 14.54 $ 10.96

Holders

As of January 31, 2012, there were approximately 3,750 holders of record of our common stock.

Dividends

We expect to retain any future earnings to fund our operations and meet our cash and liquidity needs. In addition, our ability to pay dividends or

repurchase common stock is restricted under several of our credit facilities. Therefore, we do not anticipate paying any dividends on our common stock or

repurchasing common stock for the foreseeable future.

22