Delta Airlines 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 1A. RISK FACTORS

Risk Factors Relating to Delta

Our business and results of operations are dependent on the price and availability of aircraft fuel. High fuel costs or cost increases could have a

materially adverse effect on our operating results. Likewise, significant disruptions in the supply of aircraft fuel would materially adversely affect our

operations and operating results.

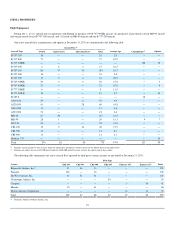

Our operating results are significantly impacted by changes in the price and availability of aircraft fuel. Fuel prices have increased substantially since the

middle part of the last decade and have been extremely volatile during the last several years. In 2011, our average fuel price per gallon was $3.06, a 31%

increase from an average fuel price of $2.33 in 2010. In 2010, our average fuel price per gallon was $2.33, an 8% increase from an average fuel price of $2.15

in 2009. In 2008, our average fuel price per gallon was $3.16, a 41% increase from an average price of $2.24 in 2007, which in turn was significantly higher

than fuel prices just a few years earlier. Fuel costs represented 36%, 30% and 29% of our operating expense in 2011, 2010 and 2009, respectively. Volatility

in fuel costs has had a significant negative effect on our results of operations and financial condition.

Our ability to pass along the increased costs of fuel to our customers may be affected by the competitive nature of the airline industry. We often have not

been able to increase our fares to offset fully the effect of increased fuel costs in the past and we may not be able to do so in the future. In addition, our aircraft

fuel purchase contracts do not provide material protection against price increases or assure the availability of our fuel supplies. We purchase most of our

aircraft fuel under contracts that establish the price based on various market indices. We also purchase aircraft fuel on the spot market, from offshore sources

and under contracts that permit the refiners to set the price.

We are currently able to obtain adequate supplies of aircraft fuel, but it is impossible to predict the future availability or price of aircraft fuel. Weather-

related events, natural disasters, political disruptions or wars involving oil-producing countries, changes in governmental policy concerning aircraft fuel

production, transportation or marketing, changes in aircraft fuel production capacity, environmental concerns and other unpredictable events may result in

additional fuel supply shortages and fuel price increases in the future. Additional increases in fuel costs or disruptions in fuel supplies could have additional

negative effects on us.

Our fuel hedging activities are intended to provide an offset against increases in jet fuel prices. Our obligation to post collateral in connection with our

hedge contracts may have a substantial impact on our short-term liquidity.

We actively manage our fuel price risk through a hedging program intended to provide an offset against increases in jet fuel prices. This fuel hedging

program utilizes several different contract and commodity types, which are used together to create a risk mitigating hedge portfolio. The economic

effectiveness of this hedge portfolio is frequently tested against our financial targets. The hedge portfolio is rebalanced from time to time according to market

conditions, which may result in locking in gains or losses on hedge contracts prior to their settlement dates and may have a negative impact on our financial

results.

Our fuel hedge contracts contain margin funding requirements, which are driven by changes in price of the underlying commodity and the contracts

used. The margin funding requirements may cause us to post margin to counterparties or may cause counterparties to post margin to us as market prices in the

underlying hedged items change. If fuel prices decrease significantly from the levels existing at the time we enter into fuel hedge contracts, we may be

required to post a significant amount of margin, which could have a material adverse impact on the level of our unrestricted cash and cash equivalents and

short-term investments.

Our funding obligations with respect to defined benefit pension plans we sponsor is significant and can vary materially because of changes in investment

asset returns and values.

As of December 31, 2011, our defined benefit pension plans had an estimated benefit obligation of approximately $19.3 billion and were funded through

assets with a value of approximately $7.8 billion. The benefit obligation is significantly affected by investment asset returns and changes in interest rates,

neither of which is in the control of Delta. We estimate that our funding requirement for our defined benefit pension plans, which are governed by ERISA and

have been frozen for future accruals, is approximately $700 million in 2012. Estimates of pension plan funding requirements can vary materially from actual

funding requirements because the estimates are based on various assumptions concerning factors outside our control, including, among other things, the

market performance of assets; statutory requirements; and demographic data for participants, including the number of participants and the rate of participant

attrition. Results that vary significantly from our assumptions could have a material impact on our future funding obligations.

11