Delta Airlines 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

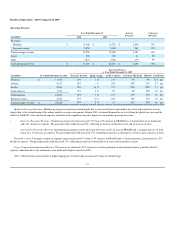

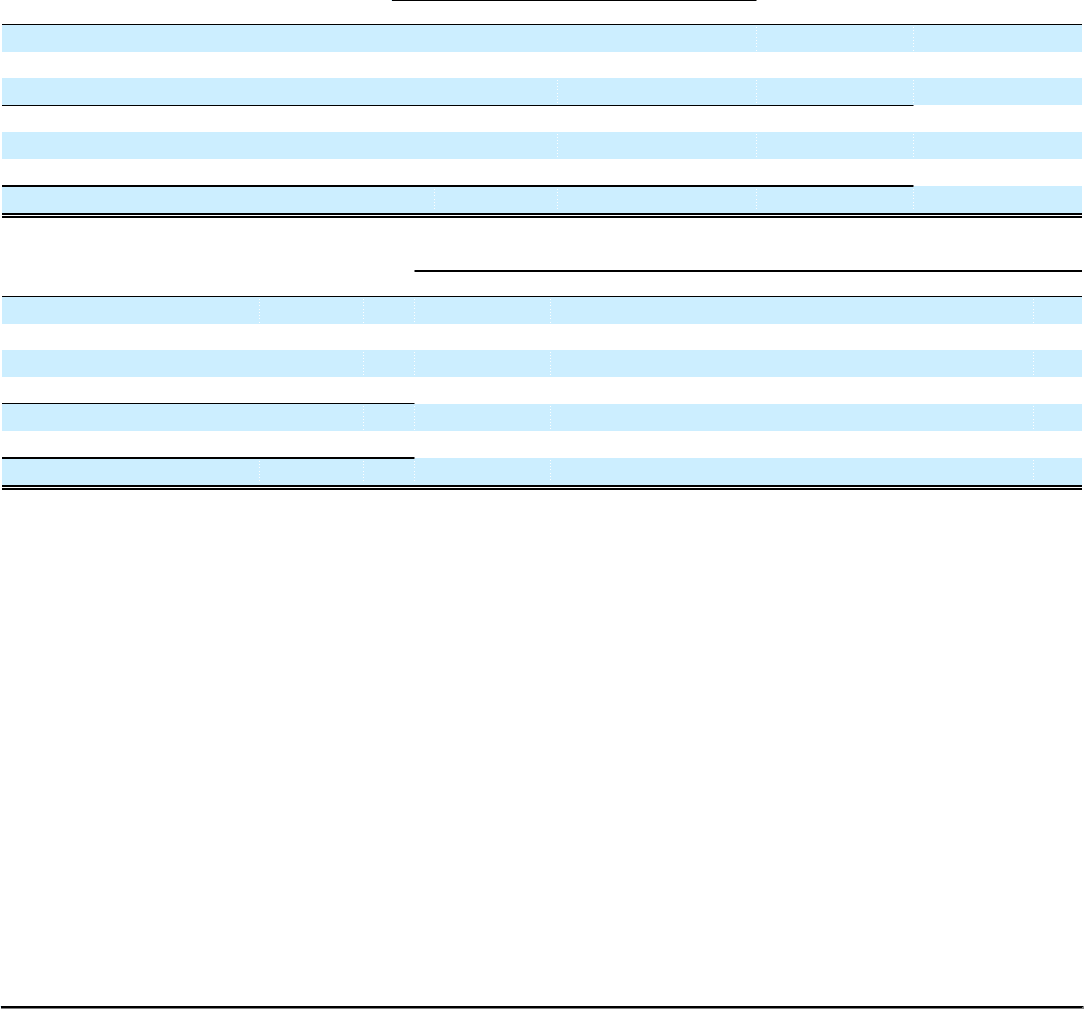

Results of Operations - 2011 Compared to 2010

Operating Revenue

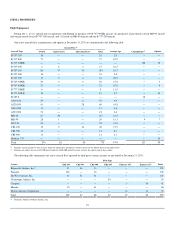

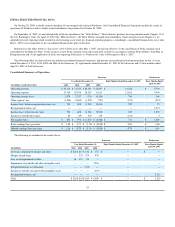

Year Ended December 31, Increase

(Decrease) % Increase

(Decrease)

(in millions) 2011 2010

Passenger:

Mainline $ 23,864 $ 21,408 $ 2,456 11%

Regional carriers 6,393 5,850 543 9%

Total passenger revenue 30,257 27,258 2,999 11%

Cargo 1,027 850 177 21%

Other 3,831 3,647 184 5%

Total operating revenue $ 35,115 $ 31,755 $ 3,360 11%

Increase (Decrease)

vs. Year Ended December 31, 2010

(in millions) Year Ended December 31, 2011 Passenger Revenue RPMs (Traffic) ASMs (Capacity) Passenger Mile Yield PRASM Load Factor

Domestic $ 13,129 11% — % (1)% 11% 11% 0.4 pts

Atlantic 5,590 9% (1)% 2 % 10% 7% (2.1) pts

Pacific 3,368 20% 4 % 10 % 15% 9% (4.7) pts

Latin America 1,777 13% — % — % 13% 13% (0.6) pts

Total mainline 23,864 11% — % 1 % 11% 10% (1.0) pts

Regional carriers 6,393 9% (2)% (2)% 12% 12% 0.1 pts

Total passenger revenue $ 30,257 11% — % 1 % 11% 10% (0.9) pts

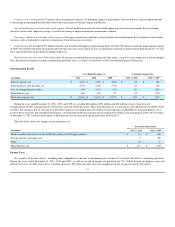

Mainline Passenger Revenue. Mainline passenger revenue increased primarily due to an improvement in the passenger mile yield from fare increases

implemented in response to higher fuel prices and from higher revenue under corporate travel contracts.

•Domestic. Domestic mainline passenger revenue increased 11% due to an 11% improvement in PRASM on a 1% decline in capacity. The

improvement in PRASM reflects higher passenger mile yield driven by fare increases.

•International . International mainline passenger revenue increased 13% due to a 9% improvement in PRASM on a 4% capacity increase. Passenger

mile yield increased 12% , reflecting increased business and leisure travel and increased fares, including fuel surcharges. Atlantic passenger revenue

increased 9% due to a 7% increase in PRASM. We and the industry faced overcapacity in the Atlantic, particularly in early 2011, which prevented us

from increasing ticket prices sufficiently to cover higher fuel prices. Pacific passenger revenue increased 20% on a 10% capacity increase. Pacific

passenger mile yield increased 15% due to a stronger revenue environment, partially offset by the negative impact from the March 2011 earthquake

and tsunami in Japan. Latin America passenger revenue increased 13% , benefiting from a 13% higher passenger mile yield driven by fare increases.

Regional carriers. Passenger revenue from regional carriers increased 9% due to an 12% improvement in PRASM on a 2% decline in capacity. Passenger

mile yield increased 12%, reflecting fare increases we implemented in response to increased fuel prices.

Cargo. Cargo revenue increased 21% due to a 12% improvement in yield and an 8% increase in volume.

Other. Other revenue increased $210 million due to higher maintenance sales to third parties by our MRO services business and $65 million due to an

increase in the volume of ticket change fees. These increases were partially offset by $90 million in lower baggage fee revenue, resulting from an increase in

bag fees waived for premium customers and customers under our co-brand credit card agreement with American Express.

28